Within this section you will find

Overview

Financing is currently the biggest challenge faced by almost developers. While the specifics of the challenge might be different for small developers from those for the large developers, there is no denying that the ability to raise financing at optimal terms is a critical factor for the success of MW solar power plants in India.

[showad block=2]

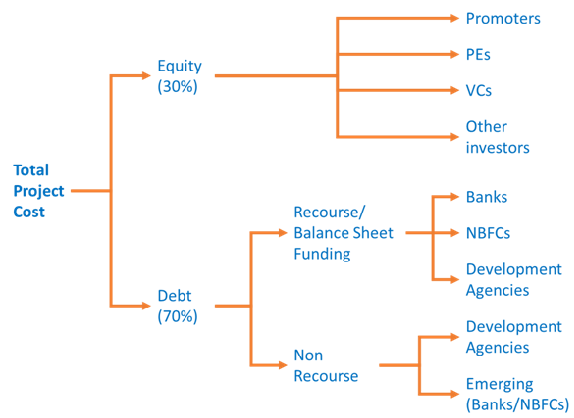

MW scale solar plants in India are financed through a mixture of debt and equity, from various sources, as shown in the chart on the following page.

- Total project cost is about Rs. 6.1 Crores/MW

- This is financed through a Debt-Equity mix

- Equity – 30% (about Rs. 1.8 Cr/MW)

- Debt – 70% (about Rs. 4.3 Cr/MW)

- Equity is primarily contributed by the promoter of the plant. Some private equity infusion is also possible

- Debt – Most financial institutions only offer With Recourse (i.e., collateral will be required) debt. Both domestic and international debt is available

- Foreign debt may provide lower interest rates, but cost of hedging for foreign exchange rate risk should be taken into account

- Domestic debt is typically for 10-15 years (a few banks go up to 20 years) while foreign debt could have a 16-18 year tenure

- It typically takes 6-9 months to close financing

[showad block=3]

Marketing & Go-to Market Strategies for MW Solar

The MW-scale, grid connected solar power plants belong more to the core power generation sector than to any other business sector. MW solar power plants are all about power plant construction, maintenance over a long period and supplying power to the grid. And finally, dealing with large utilities, and yes, with the government.

The nature of MW-scale solar power sector provides business opportunities for a number of domains

- Power Plant Developers

- EPCs and System Integrators

- Land Owners and Land Brokers

- Construction Companies

- OEMs & Suppliers – Panels, Inverters, Mounting Structures and Other Balance of System

- Financial Investors – Banks, Private Equity Firms, Other Non-Banking Financial Institutions

- Support Services – O&M service providers, O&M solution providers, IT solution providers

For those keen on entering the MW solar sector for any of the above opportunities, it is important to align the marketing strategies to key drivers and needs of the business.

Thus, a successful marketing strategy needs to be built based on the following:

- Types of businesses and business models for MW Solar

- Profiles of customers

- Needs of customers

- Nature of competition

From the above list, it can be seen that a large spectrum of financial institutions can contribute to the MW solar power plants’ developments, the prominent being

- Banks

- NBFCs (Non-Banking Financial Institutions)

- Development Agencies

- PEs

- VCs

The specific opportunity that each of the above cater to could be different. While banks, NBFCs and development agencies can cater to the conventional MW scale power plants with strong power purchase agreements (PPAs), PEs might cater to those MW scale efforts that have the potential to create a significant upside in future – this could for instance refer to a developer who is investing in solar, wind and biomass power plants and as a result could be building a combination that could be valued much higher than pureplay solar power plants. Venture capital companies currently play a limited role in MW scale solar, except in those cases where innovative technologies are being tried out – an example of this is efforts to build MW scale power plants with CPV technologies or efforts to integrate storage solutions with MW scale power plants, both of which are still in the exploration (high risk, high return) stage and hence aligned to the VC way of investing.

Related Articles

1. Business Models for MW Scale Solar PV in India

2. Key Customer Segments for MW Scale Power Plants

3. Competitor Scenario for MW Solar Power Plants

4. Drivers & Challenges for MW Scale Power Generation in India

5. Solar Thermal – Products and its Market Status

6. Market Status of Offgrid Solar Products in India

Skip to content

Skip to content