India Solar Power for International Investors

Detailed Guide on Solar Developer Business Opportunities for International Investors

The report provides insights on solar power plant development opportunities, gives detailed inputs on past and present investment trends in solar project development as well as government policies and regulations for various opportunities.

To know more about purchasing the Expert Report: Send an email to Muthukrishnan – muthukrishnan@eai.in

Solar Power Plant Investment Opportunity

- The solar sector has been witnessing significant foreign investor funding in the last couple of years, with many firms already having a large solar portfolio of projects in the country

- Solar is a $100 billion (6 lakh crore) business revolution in India. The explosive growth of the solar sector in India has seen many large and small businesses consider entering the solar space.

- Key decision makers in large corporates, millions of small businesses and enterprising individuals are exploring the best ways to enter the solar energy sector

Prominent International Solar Investments in India – 2016

- Finnish state-run utility Fortum Corp. will invest €200-400 million (Rs. 1,500-3,000 crore) in India’s solar energy sector

- SoftBank chairman Masayoshi Son has pledged to invest in 20 GW of solar projects in India. In fact, SoftBank has already started building their first solar initiative.

- Dutch pension fund asset manager APG Asset Management in collaboration with an Indian partner invested $132 million (Rs.900 crore) in Essel Infrastructure Ltd’s solar platform across India

- The local unit of Hong Kong-listed CLP Holdings Ltd is planning to invest about $1 billion for setting up over 1 gigawatt (GW) of solar power capacity over the next 3-5 years

- I-Square Capital, a private equity firm has made a $150 million equity commitment with Amplus Solar, a solar EPC solution provider with a focus on installing BOOT-based solar projects

About the Report

The above developments indicate an increasingly attractive business environment for investing in developing solar power projects. The India Solar Market for International Investors Report is a focused guide designed for a prospective foreign investor.

Who should purchase this report?

- International developers interested in the Indian solar power sector

- International financial institutions keen on investing in the Indian solar power sector

- Venture capital & Private equity firms exploring investments in this domain

Why should you purchase this report?

There are three reasons why this report will be ideally suited for a foreign investor.

- Data Accuracy: There is a lot of inaccurate and inauthentic information available on the internet, in the newspapers and various other sources which can skew investor decision-making into solar. In this report, the investor gains access to highly accurate and reliable data.

- Case Study Approach: Solar Mango undertakes a practical approach by taking a look at ground realities and analyzing these for a prospective investor. By diving into specific details of various successful and failed investments, Solar Mango provides the investor key insights that enable him/her make right decisions.

- Market Intelligence: The report provides the reader critical market intelligence on attractive regions in India for getting involved in the solar development business as well as information on upcoming auctions and emerging opportunities in the

What are the key aspects covered in this report?

This report provides unique insights and critical data points on the following topics.

- Potential returns associated with different business opportunities

- Risks faced by businesses entering solar sector as well as risk mitigation strategies for international investors

- Policy attractiveness for International investors

- Investment climate for solar investments in different states

- Recent solar investments in the Indian market and their success/failure stories

Why should you buy this report from Solar Mango?

Solar Mango’s Expertise in the Solar Sector

- Solar Mango is one of the most respected brands in the Indian solar sector

- Considered the #1 solar guide, our expertise in the technical, market and commercial aspects of solar energy has benefitted over 1500 stakeholders – ranging from industries, commercial establishments, small businesses, entrepreneurs, government, educational institutes and more

- Through our focused consulting assignments and research reports, and our team of industry specialists, we bring in in-depth expertise in many critical aspects of solar power plant, especially solar PV

Solar Mango’s Contacts in the Indian Solar Sector

- Being a pioneer in solar power industry research and consulting (we have been serving the Indian solar power market since 2009 when the solar power growth was just beginning)

- We also own some of the leading online resources for solar energy in India, Solar Mango has one of the most extensive contact networks with solar industry specialists and experts in the field.

Snapshot of Solar in India

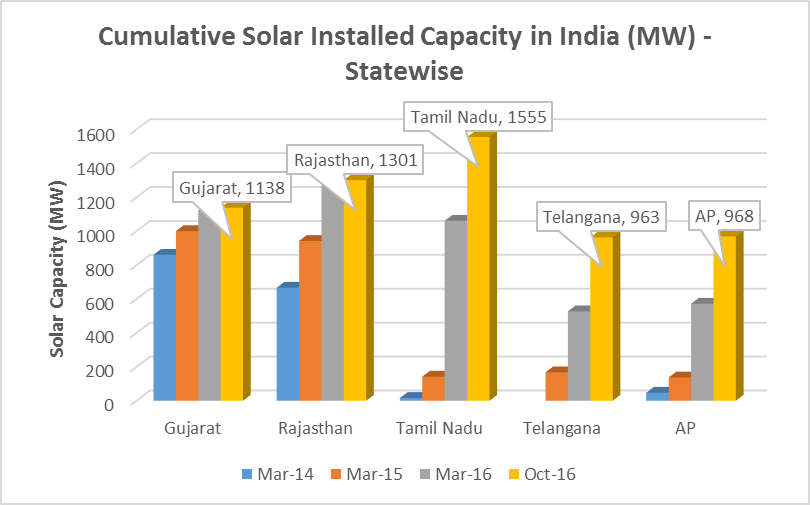

State-wise Growth

Source: MNRE

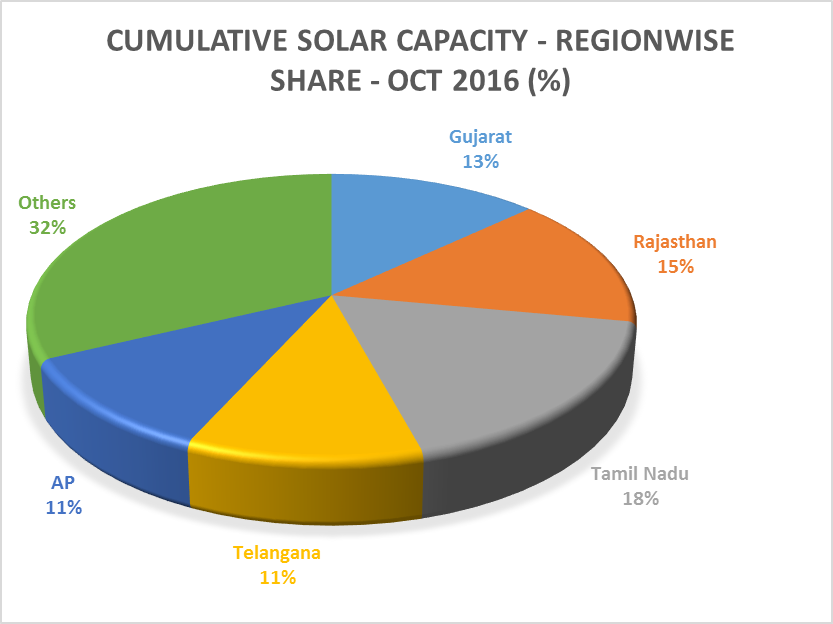

State-wise Market Share (%)

Source: MNRE

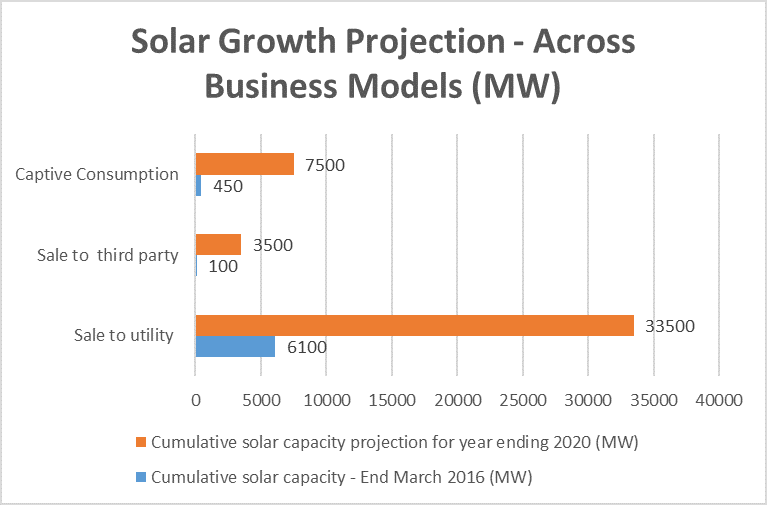

Solar Trends Across Business Models

Source: Solar Mango Analysis

Mergers and Acquisitions

A recent post by Bridge to India suggests that the merger and acquisition (M&A) activity in the solar sector is significantly large with about 3,000 MW of projects on sale (as of June 2016).

Take a look at some developments in the secondary market which took place in the year 2016.

| Acquisition/Merger Activity | Parameters | Details |

| Tata Power’s Acquisition of Welspun’s Renewables

|

Transaction Value | $1.38 billion |

| Acquired solar capacity | 900 MW | |

| Per MW Deal Valuation by Experts | Rs 7-8 Crore/MW | |

| Actual Cost of setting up a plant | Rs 5-6 Crore/MW | |

| Greenko’s purchase of SunEdison’s Utility Solar Assets

|

Acquired Capacity | 390 MW solar, 48 MW wind |

| Deal Valuation | $392 million (project-level debt – $350 million, equity investment – $42 million) | |

| Marquee Projects | 500 MW project in Kurnool, Andhra Pradesh | |

| Amplus’s purchase of SunEdison’s rooftop solar assets

|

Acquired Capacity | 7 MW |

| Newly acquired clients | Whirlpool, Intel, Standard Chartered and Delhi Metro | |

| State-wise spread of assets | Maharashtra, Karnataka, Tamil Nadu and Delhi

|

|

| CLP – Suzlon joint venture for developing 100 MW solar park in Telangana | Joint Venture Stake | CLP – 49%, Suzlon – 51% |

| Investment | 760 crore | |

| Project Details | PPA Rate – Rs 5.59/unit

PPA Period – 25 years Discom – Telangana Southern Power Distribution Company |

Key Topics Covered

Solar Power Scenario in India

- Solar power plant potential in India

- Overview of business models

- Rooftop

- CAPEX

- OPEX

- Ground-mounted

- Sale-to-utility

- Captive

- Third-party

- Rooftop

- Solar power growth trends

- Solar Power Installed Capacity

- Region-wise

- Sector-wise – rooftop and ground-mounted

- Categorization based on business models

- Solar tariff trends

- Region-wise

- Sector-wise – ground-mounted and rooftop

- Based on business models

- Solar Mango forecast for solar capacity additions

- Solar Power Installed Capacity

- Lever’s impacting solar power plant growth in India

Business Opportunities for Solar Developers

- Overview of solar PV value chain opportunities

- Analysis of the solar power plant opportunities

The opportunities discussed include

- Solar power plant development

- Secondary market for solar farms

- O&M

- Other opportunities

- Asset Management

- IT solutions

- Support services – project liasoning, Owner’s Engineer etc.

- Mergers and Acquisitions

The various solar power generation opportunities are evaluated based on the following set of parameters

- Competitive landscape

- Investment required

- Business models

- Payback period

- Margin potential

- Indicative returns/margins

- Overview of solar PV manufacturing opportunities

- This section gives you a brief analysis of manufacturing opportunities in the solar PV value chain based the following parameters

- Competition

- Investment required

- Policy Drivers

- Risks and Returns

- This section gives you a brief analysis of manufacturing opportunities in the solar PV value chain based the following parameters

Scenario Analysis of Solar Power Plant Opportunities

This section performs a returns analysis of various business opportunities.

Analysis of potential returns

- Sector-wise – rooftop and ground-mounted

- Business models

The input and output parameters for the analysis is listed below

- Input parameters

- Plant capacity

- Interest rates

- CUF

- Tariffs

- Output parameters

- Payback period

- Equity IRR

- Project IRR

Financing and Funding Activity

- Top international investors in the solar sector

- VC, Debt Funding Deals

- Rooftop

- Ground-mounted

- Mergers and Acquisitions

Risks and Mitigation Strategies

The major risks along with suitable inputs for mitigating these risks will be provided in this chapter for all the different business opportunities.

- Project Completion Risks

- This refers to the various time delays and cost overruns which directly or indirectly affect the course of the entire project

- Country Risks

- This covers the economic and political risks including government stability, ease of doing business and financial risks like currency risks, interest rates, and insurance risks

- Operational Risks

- This covers the risks associated policy uncertainties, supply constraints, and technology improvements

- Market Risks

- This covers the risks associated with competition from overseas players, price pressures, and marketing

Project Allocations, Announcements and Government Policies

- Solar project bids and allocations

- Solar auction announcements

- Central and State Policies

- State-wise attractiveness of foreign ventures

- Evaluation based on the ease of doing business, solar policy favorability, infrastructural support and other parameters

Case Studies

- Leading international investors and corporate-backed investments in India along with their success and failure stories

- Some prominent solar investments pouring into India that will be covered in the report include

- SunEdison Inc

- SoftBank Corp

- Fortum Corp

- CLP Holdings

- APG Asset Management

- Morgan Stanley

- I-Square Capital

- First Solar

- Moser Baer

To know more about purchasing the Expert Report: Send an email to Muthukrishnan – muthukrishnan@eai.in

PRICE OF REPORT: Rs 67,500 (US $999)

About Solar Mango

Solar Mango is a division of Energy Alternatives India (EAI), India’s largest renewable energy and clean technology research and consulting firm.

The range of services Solar Mango provides include

Assistance for International firms

Solar Mango provides specialized assistance to International solar firms who wish to enter the Indian market. While we provide such assistance to the entire renewable energy spectrum, we have a special focus on the Solar PV sector within this portfolio. Our services cover:

- Understanding of the Indian Market & Regulatory Structure

- Market Potential Studies

- Competitor Analysis

- Developing and Implementing Marketing & Sales Strategies

- Identifying Joint Venture/Marketing Partners

- Business Incorporation, Setting Up Office, Recruitment of Key Personnel

International Clients whom we have assisted –

- Solar Mango assisted the World Bank in getting a thorough understanding of solar and other renewable energy investments in India.

- Solar Mango provided turnkey market entry and market development assistance for a major German firm in the solar plant monitoring space to enter, recruit, conduct road shows, and acquire prominent customers for the Indian market.

Other Clients –

Skip to content

Skip to content