For those keen on becoming a solar power developer in India, it is important to understand the various business models under which solar power plants get built.

Power plant development belongs more to the infrastructure sector than to consumer product sector, in the sense that these are investments that pay off well in the long term, and in that these are businesses that rely on long term agreements rather than dynamic short term sale transactions.

This post from Solar Mango looks at some of the key aspects that any developer of MW solar power plants should know.

Please note that this post is mainly about business models for MW-scale, grid connected power plants and not for rooftop solar power plants for which the business models could be quite different!

|

For any business keen on having MW scale solar power plants, the first and most important question they should ask themselves is: Who will buy the power? |

The answer to this question to a significant extent will decide the business and revenue model for the power plant, and also pretty much define the risk and return profiles. To a certain extent, the type of buyer could also determine the financial returns on the project.

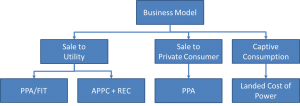

A utility scale Solar PV plant can be monetised through several avenues:

Business Models for MW Scale Solar

Broadly, you could say that the sale of power is either to a power utility (typically a government owned electricity board) or to a private company. In the special case where the private company happens to be the owner of the power plant, it becomes a Captive Consumption model.

Except in the case of captive consumption, the key contract that forms the business model is the PPA or the Power Purchase Agreement. Here is post that explains the PPA much better.

Each of the above business avenues is explained below.

Sale to Utility (DISCOM)

Utility usually refers to state power generation or distribution companies (TANGEDCO, APTRANSCO, MAHAGENCO) or other large central power entities such as NTPC.

There are two ways you could sell power to these state utilities.

- PPA/FIT – A Power Purchase Agreement (PPA) is signed with the DISCOM, usually for 25 years, where the price of power (Rs./kWh) is either determined through competitive bidding or a Feed-In-Tariff (FIT) is fixed by the government. This is the most popular form of power sale in India today

- One of the earliest FITs in the country was the Gujarat FIT in 2009 at Rs. 15 (Years 1-12) and Rs. 5 (Years 13-25)

- In contrast, the latest announced allocation for Telangana (April 2015) caps the bids at Rs. 6.45/kWh (for the entire 25-year period)

- APPC + REC – The solar plant developer sells power to the DISCOM at Average Pooled Power Cost (APPC) which is fixed by each state, and is usually lower than the PPA/FIT tariff (Madhya Pradesh APPC – Rs. 2.79/kWh; Karnataka APPC – Rs. 3.06/kWh). The developer additionally receives Renewable Energy Certificates (RECs) that can be sold to entities with a Renewable Purchase Obligation (RPO). This model is currently not very popular in India due to poor sales of RECs

Sale to Private Consumer

A private company is free to purchase power from whoever they wish, with only a few constraints attached. You could sell the power generated to private companies as well. This route typically is through a power purchase agreement.

- PPA –The solar plant developer signs a PPA with a private consumer for sale of power. The price is usually decided based on negotiation. The PPA term may only be 5 years initially. The private consumer will need to apply for Open Access to buy power from anyone other than the utility

- Solar developers who sell power to private consumers are entitled to RECs, provided the consumer is not under a Solar Purchase Obligation

Captive Consumption

For power plant developers who also happen to be running energy intensive businesses, the third route to sell power is through the captive consumption of the solar power generated by their own power plant.

- The solar plant developer is also the consumer of power. Here, the cost to consumer is the cost of obtaining solar power at the facility i.e., landed cost of power

- A captive plant need not be located at the facility. If located some distance from the facility, the cost of transmitting power to the facility (including open access charges) will need to be paid to the grid operator. This cost will need to be added to the cost of generation of solar power to arrive at the landed cost of power at the facility

Solar generation under captive consumption is also eligible for RECs, provided that no concessions have been obtained.

Pros and Cons of the Business Models

| Biz Model | Pros | Cons |

| Sale to Utility | Long term PPAs viable and bankable, in the case of at least some states

Large power plant PPAs possible as the buyer is a very large distributor of power |

Rates might not be very attractive, especially in the regime of competitive (reverse) bidding

Poor health of state DISCOMS could pose payment delays and hence poor cash flows This model is allotment driven and hence feasible only under scenarios where there are such government allotments |

| Sale to Private Consumer | No need for government policies or allotments, purely market driven

Could have attractive tariffs, as this is a bilateral agreement between two private parties REC benefits can be availed, through the market for RECs is yet to take off meaningfully |

Long term PPAs are difficult except in the cases of very large corporates

Large corporates might set up their own captive solar power plants instead of buying from third parties, and so there might be challenges for this attractive segment High wheeling, banking and cross subsidy charges might weaken the business case |

| Captive Consumption | No need for government policy or allotments, purely driven by the cost of energy

Tying in the cost of energy for your company for 25 years, as against uncertain grid power cost escalations during the same period REC benefits can be availed, through the market for RECs is yet to take off meaningfully |

This might not be possible for every developer. In fact, IPPs in most cases operate only power plants and they have no other businesses (though they might have companies that are related to them in some fiduciary way)

Captive power plants require significant upfront capital costs, something many companies might not find feasible |

Key Takeaways

| The first and most important question any MW solar power aspirant should ask is: Who will buy my power?

There are three main types of buyers for a utility-scale, MW solar power generator o Government utilities, usually through state or central solar policy allotments o Private companies, through a mutually negotiated power purchase agreement o Self-consumption (captive power plant) Each of the above three buyer-routes has its own pros and cons, and thus, there is no one avenue that is “best” for all developers |

Skip to content

Skip to content

Dear Narasimhan,

Your posts are awesome and give a great perspective about the solar industry. The greatest thing about your posts is the selfless manner in which you share such data and analysis which large number of professionals hold close to their heart as a proprietary information.

Your effort will go a long way in supporting professionals in this field. We are a young company started by ex Army officers to bring the ethos of soldiers in this growing industry. Presently we are focussed on off grid as well as grid tied roof top solar power plants in Northern region but by virtue of our network we have pan India access and have done projects from Ladakh to Arunachal Pradesh, Uttarakhand, Haryana, Punjab, Bihar, Jharkhand, etc

We would love to interact with you while you are in Delhi so that we can chart a path of mutual growth.

Regards and Best of Luck

Regards

Lt Col Rajive Sinha (Retd)

Director, LED & Solar Energy Solutions

Def Mart Pvt Ltd

South City 1, Gurgaon

Mobile : +919650862726

Office : +91-1242381077

Thank you Rajeev for your kind words. Really appreciated.

It appears that you are doing some wonderful work in solar, and from what I see at your web site http://www.defmart.co.in/, you are dealing in a good lot of offgrid solar products, both solar PV and solar thermal. A much needed solution for select areas in India!

I will be glad to keep in touch; Will surely ping you when I am next in Delhi and we can catch up

Thanks once again, and all the best to Def Mart Pvt Ltd.

Narasimhan

Solar Mango

Dear Narasimhan,

Grateful for such a prompt reply.

Would love to interact while you

are at Delhi next.

Regards

Rajive

Mr Santhanam

I also wish to place on record my appreciation for the high quality of information and insights you provide on your web site.

We have learnt most of what we know in solar from Solar Mango.

Thank you very much once again and all the best to Solar Mango

Vish Iyer

Hyderabad

Thank you Vishwanath

I do hope I am able to assist you guys further along

Thanks again

Mr Santanam

Is the solar leasing model picking up in India – where I lease my rooftop space to a solar power developer and collect a monthly rental? How is this business model, is this attractive?

Dear Neelkamal

Interesting question

From the work we have done at Solar Mango, we have come across a few instances where our assistance was sought for what appears to be on the leasing mode, though some of these also had a small revenue share component. In fact, in two of the cases, the lease rent was paid more as a revenue share, not sure if this fits the classical definition of leasing which is more of a fixed rent.

Overall, I would say leasing is in its very early stages in India, and it has been predominantly (and not surprisingly) warehouses and similar infra with huge rooftops but little electricity consumption that have been opting for these…

Expect more action in this segment in 2016

Can we get better profits by selling to private cos – becos tariff bid for govt ppa are very low now – only 4.63 rs, which is not viable??

Third party sale of solar power – while appearing like a great idea on paper – is tougher on the ground than expected.

The reasons, according to an analysis we did at Solar Mango, are the following:

1. Switching power suppliers is not something companies do quickly, and as a result, they are taking their own sweet time

2. Except in states such as Maharashtra and Gujarat where the power tariffs to commercial and industrial enterprises are already quite high, the difference between the grid power price and what the IPPs are offering for solar power has not become significant yet

3. Companies are wondering if they should wait a bit longer for solar power prices to fall further before they sign up on long term PPAs.

4. Of course, another set of companies are asking themselves why they should not put up a solar power themselves instead of purchasing it from someone else!

Perhaps as a result of the above, we have so far seen only lukewarm response to sale of solar power to private companies, but these are early days indeed, and let’s hope 2016 rings in and brings in better clarity on this.

More than the business model, one should look at whether the offtaker has the financial strength to honour the PPA. This is the concern banks have with resPect to the state discoms

Outside of the above models, is there any other emerging business model for mw solar farms?

Arjun

You are bang on target about the offtaker’s financial strength. With many discoms in deep red, it is indeed a concern for the banks whether they will pay and if yes, on time. This is especially the case for discoms in states such as Tamil Nadu…

Other models? Well – there are some interesting models emerging for rooftop solar, solar leasing being one of them.

On ground-mounted power plants exporting to grid, I would say the above are still the dominant models in India

The only model I can think of outside of the above from a ground-mounted context are community solar farms, where a community together has invested in a solar power plant which might either be part of a micro-grid on their premises or a ground-mounted power plant transmitting the power via the grid – the community shares the costs and benefits on a pre-determined basis

Community solar is pretty nascent, whether it is in India or worldwide.

But when I was in Bengaluru last week, I heard from a gentleman that some of the upcoming apartment complexes are considering putting up community solar power plants that all the flat owners pay for.

Dear Narasimhan

Do you think the community solar model will succeed in India?

I think captive solar for businesses will pick up in India fast because grid power cost is really increasing very fast

Dear Beant

Many thanks for your kind comment

I agree with you on this.

While captive solar power plants are just starting to gain attention from the Indian corporate sector, with the solar grid parity already having been achieved for this sector with the high prices they already pay, we indeed can expect a number of captive solar power plants to be implemented soon across India, at least in the sunny states of India, which any way is most of India!

By the way, you might also want to look at this post that deals with captive solar power plants – http://www.solarmango.com/blog/2015/12/14/captive-solar-power-plant-for-my-company-is-it-a-good-idea/

We should keep observing what types of new models are being introduced in other countries and adopt them fast in India

Dear Chinnadurai

Many thanks for your kind comment

Yes. that is one way by which we can quickly adapt the best-of-breed that is happening elsewhere in solar in India

One recent example that comes to my mind is Virtual Net Metering. I read that many US states have just about begun to offer Virtual Net Metering. Not soon after I read this, I came to know that Delhi is also considering offering the Virtual Net Metering soon …that was not bad for pace of adoption, was it?

So, yes, let us watch out for what’s good that’s happening elsewhere in solar (esp in USA, Eu & Aus) and see how best we can adopt these here too

Thanks once again for your contribution

GoI and states should come up with solar business models that can benefit the average farmer. Indian farmers who are not able to make much money from their agricutlure on their land can benefit from harvesting solar energy instead of harvesting crops. This can dramatically reduce farmer suicides in the country.

Dear Karan

Many thanks for your insightful comment

I agree with you in principle, but putting a “poor-farmer-friendly” solar scheme is a lot more difficult than the pure market driven solar schemes, mainly because the government has to figure out how to subsidise the farmers through incentives to capital cost as the poor farmers cannot be expected to bring in the high collateral or the equity required for the project, and the banks are going to be quite unwilling to forward loans to the farmers without the above.

The alternative, as I have suggested elsewhere, is for the government to put together a mechanism in which it accommodates external investors in an organized manner to invest in solar farms on farmers’ lands, and part of the revenue goes to the farmer without the farmer having to invest anything financially. This model is already working for some solar schemes around the country, where once a developer has got an attractive PPA, investors (typically corporates who can benefit from the returns as well as accelerated depreciation benefits) put in the money for the project and own it, and the original PPA holder gets a % of the revenue without having to invest any upfront equity

The above model is workable – because it is already working in some places – but the government needs to put in a tight framework so that this can scale for farmers around the country. Unless such a framework accommodating external investors is brought in, it will only be the rich farmers who benefit from the scheme.

Pingback: Super Big Resource on Solar Power Costs & Returns - Solar Mango – #1 guide for solar

Hello Mr. Narasimhan,

I really appreciate the piece of information you’ve released for the public. I am looking forward to entering solar power development and would like to get professional consultancy.

Is there anyway we could connect?

Best Regards,

Naman Agrawal

Thank you Naman for your kind appreciation and comment. My apologies for a delayed revert.

I have requested my colleague Ramya to connect with you at the earliest and understand your needs.

When time permits, please send a note to Ramya (ramya@solarmango.com ) and provide her your coordinates, so she can interact with you. Please do mark a copy to me too (narsi@solarmango.com ), and I will be glad to lend a hand where required.

Many thanks once again for your interest and appreciation. All the best

Narasimhan

Director

Solar Mango