Within this section you will find

Policies

Similar to MW Scale power generation, rooftop based solar power generation also is to a considerable extent driven by policies.

The key policies that have been driving this sector so far are

- Upfront Capital Costs

- Slow Adoption Rates

- Capital Subsidies

- Lack of Clarity in Policies

- Lack of Implementation of Incentives & Net Metering

- Net Metering

Upfront Capital Costs

Solar power has a unique constraint in that almost all the costs for the 25 year project is right in the beginning.

This is a challenge, as human beings are more comfortable paying as they go rather than pay up money up front.

Capital Subsidies

In the case of rooftop solar, there have been two types of capital subsidies – from the centre and from the states.

Central capital subsidies, where the central government subsidises through MNRE the upfront capital cost for a rooftop solar power plant, had been a driver for rooftop solar power plants until 2014.

However, two aspects made this a far less powerful tool:

- One, owing to a number of reasons, the subsidies took a long time in reaching those putting up these rooftop solar power plants, making people lose confidence in the scheme

- MNRE itself suggested early 2015 that they intend to make these subsidies quite selective, and will also decrease the subsidy from 30% to 15%

Solar Mango does not expect central capital subsidies to play a significant role in the growth of rooftop solar segment in India any longer.

Of late, some states have announced capital subsidies of their own, on top of the central capital subsidies. Notable among these are subsidy announcements from Tamil Nadu and Andhra Pradesh, each of which had announced a Rs 20,000/kW subsidy for the residential rooftop solar sector. It is too early to judge the effectiveness of this subsidy, but based on interactions Solar Mango has had with the stakeholders, it appears that this subsidy is being implemented better than those of the centre.

Net Metering

Net Metering, a concept that enables surplus power from a rooftop solar power plant to be exported to the grid and getting monetised, can be a powerful driver for rooftop solar power, especially industrial and commercial rooftop solar.

This is so because industrial and commercial buildings could have 100s of kW of rooftop solar installed; while they might use most of the solar power generated during weekdays, companies that do not work during weekends could lose out on tens of thousands of units solar power per year.

Net Metering ensures that these extra units get their due credit, and thus makes rooftop solar a more economically feasible concept for these enterprises.

Unreliable Grid Power Supply

India suffers from a power deficit of 9-10% of peak demand, which has resulted in poor power quality and productivity losses for businesses. It is estimated that industries in Andhra Pradesh alone have suffered losses of Rs. 30,000 Cr between September 2012 and April 2013 due to the power crisis. The power shortages comprise

a.Peak power deficit (MWs of capacity)

- India’s overall peak power deficit in 2012 was 9.4%

- Southern states had the maximum deficit of nearly 18.0%

- Northern regions of the country suffered a deficit of 8.9

b.Energy deficit (MWhs of energy generated)

- India’s overall energy deficit in 2012 stood at 8.7%

- Southern states experienced the highest deficit of 15%

The power deficits are caused by

- Non availability of fossil fuels at acceptable rates

- Decreasing financial health of the State DISCOMS

- Delay in commissioning of power projects

The issues surrounding each of these are complex, and are not likely to be resolved immediately. We expect the power deficit to continue in the 8-9% region for the foreseeable future. This shortage of power has significant ramifications for both businesses and residences.

Grid & Diesel Power Cost

Grid power cost is an important driver for the growth of rooftop solar power. While there is a niche segment that installs solar power on their rooftops out of a sense of environmental consciousness, a large percentage of rooftop solar installations in India – be it for residential or for commercial – will not happen unless there is a strong business and economic case for that.

With the costs of solar panels coming down, the upfront costs for rooftop solar have indeed come down dramatically, but it still is a fairly costly affair. This brings us to the concept of grid parity, which is a status when the cost of solar power is that same as that of grid power.

[showad block=3]

An alternative model that has emerged in the last few years is that is called the PPA model or the BOOT model. This takes care of the upfront capital cost constraint burden by making rooftop solar as a Pay as You Go model. More on the BOOT/PPA model in the Appendix.

Slow Adoption Rate

India has ambitious targets for rooftop solar, but on the ground, growth of rooftop solar has been rather average, between 2012 and 2015.

The central government has an awesome target of 40 GW for rooftop solar by 2022, over 100 TIMES what it is in May 2015 (a bit over 300 MW), so that should be very encouraging to entrepreneurs. At an approximate cost of 1 Lakh per kW installed, this would mean an investment of 4 Lakh Crores should the 40 GW be achieved by 2022.

Rs.4, 00,000Crores – that’s quite a business opportunity!

However, the growth so far has been stunted, and some of the key reasons and constraints are discussed in other points below.

Lack of Clarity in Rooftop Solar Policies

While some states have come up with rooftop solar policies, there is significant lack of clarity in many of these policies.

A recent review by Solar Mango team of rooftop solar policies for all those states that have announced such policies revealed three main aspects where clarity was missing

As we can see, when there is grid parity for rooftop solar, the use of rooftop solar will accelerate, as beyond this point, solar power can only cost less (as solar panels’ cost keep decreasing and the cost of fuel is free) while grid power can only increase (as it uses costly fossil fuels whose general trend will be increase in prices, though there could be temporary dips in the fossil fuel prices as it has happened since Nov 2014.

Cost of Power

Rooftop solar power costs about Rs. 7.0/kWh and is a cost-effective alternative for energy consumers where

- Net Metering – while many states had announced intentions for Net Metering, very few actually have demonstrated that Net Metering actually works in their states

- The grid tariff is higher than the levelised cost of solar power

- Targets – while most states with a rooftop solar policy had announced targets, very few states had provided an actionable blueprint for the same. As a result, there is a good amount of justified scepticism amongst businesses whether these targets were realistic and practical

- Little support from SNAs – The SNAs in very few states are well equipped to understand the technical and operational complexities involved in rooftop solar projects; as a result, they are unable to provide clear answers and directions to those who seek them in their states

Levelised cost calculated as the cost per unit of power generated, taking into account all costs incurred over the lifetime of the plant adjusted for time value of money.

- Diesel generators are frequently used

- The depreciation on the solar plant (at 80%) can be claimed against taxable profits

Grid Tariffs in Indian Cities for Industrial, Commercial, and Residential consumers

The below table gives a comparison of grid tariffs for different categories of consumers across 5 Indian cities:

| Industrial/Commercial | Residential | ||||||

| State-City | Category | Industrial Tariff | Commercial Tariff | Problems in customer acquisition | Andhra Pradesh – Hyderabad | Criticality of the problem | |

| Awaiting subsidy | 11 kV | 7.42 | 7.42 | High | |||

| Not high business priority | 33 kV | 6.77 | 6.77 | High | |||

| High Capital Cost/Raising Money | 132+ kV | 6.51 | 6.51 | High | |||

| Poor salesmanship | Medium | 50 kWh | 2.01 | ||||

| Lack of clarity | Medium | 200 kWh | 4.33 | ||||

| Negotiations with other vendors for low price | Medium | 400 kWh | 5.72 | ||||

| 600 kWh | 6.54 | ||||||

| Gujarat – Ahmedabad | |||||||

| 500 kVa | 4.67 | 4.37 | |||||

| 500-2,500 kVa | 5.00 | 4.70 | |||||

| > 2,500 kVa | 5.10 | 4.80 | |||||

| 50 kWh | 4.92 | ||||||

| 200 kWh | 4.61 | ||||||

| 300 kWh | 4.89 | ||||||

| Karnataka – Bangalore | |||||||

| 1-1,00,000 kWh | 5.75 | 1-30 kWh | 8.40 | ||||

| >1,00,000 kWh | 6.15 | 31-100 kWh | 5.24 | ||||

| 1-2,00,000 kWh | 7.35 | 101-200 kWh | 5.17 | ||||

| >2,00,000 kWh | 7.65 | 201+ kWh | 5.49 | ||||

| Maharashtra – Mumbai | |||||||

| Express feeder | 7.32 | 11.91 | |||||

| General corporate inertia | Non Express feeder | Medium | 6.58 | 11.18 | |||

| Seasonal | 8.17 | ||||||

| 100 kWh | 5.65 | ||||||

| 300 kWh | 5.44 | ||||||

| 500 kWh | 7.10 | ||||||

| 600 kWh | 7.07 | ||||||

| Tamil Nadu – Chennai | |||||||

| 5.98 | 7.61 | ||||||

| 99 kWh | 1.30 | ||||||

| 199 kWh | 1.70 | ||||||

| 499 kWh | 2.76 | ||||||

| 600 kWh | 4.13 | ||||||

Note: The above tariffs are only indicative and calculated as an average for each type of consumer. Actual tariffs vary based on several factors such as supplying utility and proportion of variable to fixed charges.

As can be seen, some consumers at certain locations can save immediately from rooftop solar. It should be noted that the cost of solar power is fixed for the next 25 years while the cost of grid power will continue to increase, thereby increasing the savings from a solar PV plant in the future.

High Cost of Diesel Power

Compared to solar power’s Rs. 6.0-7.50/kWh, diesel generators generate power at about Rs. 16/kWh (a litre of diesel generates around 3-4 kWh). Diesel power can be even more expensive once other losses such as pilferage, evaporation, etc. are considered. In some applications, such as rural telecom towers, diesel power can cost as much as Rs. 40/kWh!

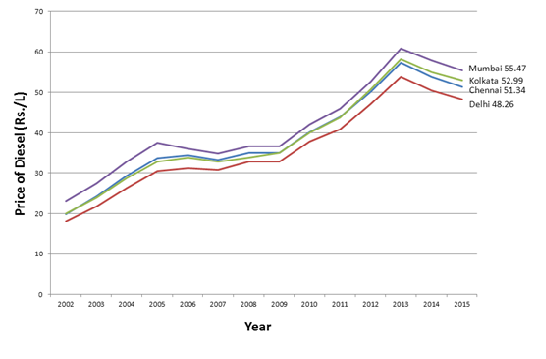

The cost of diesel power has seen a steep increase over the last 10 years, shown in this chart

This continuing upward trend in cost of diesel power makes a compelling case for residences and industrial/commercial units that consume a lot of diesel to switch to solar power.

Urge to Go Green and Corporate CSR

There is a niche among industrial and commercial establishments that are keen to go solar on their rooftops. Solar Mango has worked with many of them between 2012 and 2015 in which we saw from close quarters how many of these establishments had installed rooftop solar power plants.

The driver for this segment is more the aspiration to go green rather than the economics.

While it is difficult to state specific sectors, demographics, or regions that are strong on the Go Green behaviour, Solar Mango urges entrepreneurs to have a special focus on this segment, as this is the segment that focuses on quality and not costs alone. Thus, as an entrepreneur catering to this segment, you will get the satisfaction of implementing a high quality plant for a discerning customer.

Related Article

1. Types of Solar PV Rooftop Systems and Rooftop Solar Segments

2. Key Drivers for Rooftop solar Power in India

3. Attractive Segments and Innovations in Rooftop Solar Sector

4. Drivers of Off-grid Solar Market Growth in India

5.Government Initiatives/ Programs to Support Off-Grid Renewable Energy Deployment in India

6.Drivers & Challenges for MW Scale Power Generation in India

Skip to content

Skip to content