Internal Rate of Return

Before going into Internal Rate of Return of a utility scale solar power plant, we need to understand the concept of Net Present Value (NPV). NPV negates the problem of having to compare cash flows in different time periods. The value of a rupee now wouldn’t be the same five years down the lane. NPV brings the future cash flow to its value today (present value) by estimating how much value money loses over time.

Internal Rate of Return (IRR) also considers the time-value of money and is aptly called time-adjusted rate of return. The IRR is defined as the discount rate that makes the present value of the cash inflows equal to the present value of the cash outflows in a capital budgeting analysis. Effectively it is the factor that makes the NPV of cash flows as zero. It is always expressed in percentage. Naturally, a higher IRR is better than a lower one.

Wish to purchase high performing solar panels?

Talk to our Expert team – Send a note to sourcing@solarmango.com

What is debt and equity?

MW scale solar plants in India are financed through a mixture of debt and equity.

Debt is the money that is borrowed and has to be repaid with interest periodically. For example, using a credit card or getting a home loan is a form of debt financing.

Equity involves the presence of investors, which means, having a share in the business you are trying to invest in.

What is equity IRR and project IRR?

When a project is financed by means of equity as well as debt, we have to take into consideration equity IRR as well as project IRR.

Calculation of the internal rate of return considering only the project cash flows (excluding the financing cash flows) gives us the project IRR whereas calculation of the internal rate of return considering the cash flows net of financing gives us the equity IRR.

Equity IRR represents the degree of returns of a project to the providers of equity capital. For profitable investments, equity IRR is always higher than project IRR. Equity IRR will reduce if equity portion is increased as leverage provided by debt reduces. If there is no debt, then equity IRR is same as project IRR.

What is the expected equity IRR from a solar project?

IRR is affected significantly by

- Tariff rates

- Accelerated depreciation

- Proportion/cost of debt

Based on the bidding/tariffs we have seen this year and with some assumptions about plant performance we have seen equity IRRS in the range given below:

Without AD: 14-20%

With AD: 15-23%

But the above estimates are only indicative because there are always outlier cases where the equity IRRs have been significantly beyond the upper end of range mentioned above, for both projects with and without AD benefits.

How to best increase my IRRs – by going for cheaper solar power plants or investing in quality for higher solar power yields?

While any investment requires a cost/benefit analysis, it is better to invest in better quality and higher yield as the reliability of lower cost plants is uncertain. Frequent breakdowns require replacement of parts leading to higher cost and the revenue is lost during downtime due to repairs.

Moreover, refinancing at lower interest rate becomes more difficult if plant is perceived to be unreliable both in revenue generation and cost control.

What are the additional factors that can vary IRR for a solar project?

Some of these factors have been listed below:

- Capacity Utilization Factor

- Module Degradation factor

- Escalation of O&M costs

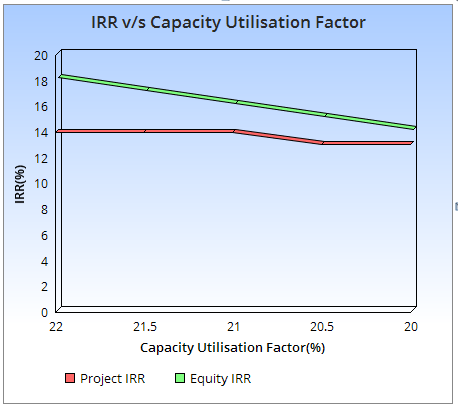

The following graph is plotted for a 2 MW solar power plant with a tariff rate of Rs 6.5 per unit in order to illustrate the variation in IRR (project and equity IRR) with CUF.

|

Capacity Utilisation Factor (%) |

Generation in the FirstYear(million

units) |

Project IRR(%) |

Equity IRR(%) |

| 22 | 3.854 | 14 | 18 |

| 21.5 | 3.766 | 14 | 17 |

| 21 | 3.679 | 14 | 16 |

| 20.5 | 3.591 | 13 | 15 |

| 20 | 3.504 | 13 | 14 |

It can be concluded from the graph that CUF can affect the equity IRR considerably and hence maintaining optimum levels of plant performance is vital.

Related Articles

- What are the Initial Investment and O&M Costs Required for a MW Solar Plant in India? What Kind of Financial Returns can We Expect from It?

- What are the Financing Options Available for MW Solar Plants in India?

- Is Solar Power the Best Sector for Me to Invest My Money in?

- What are the Incentives Available for Rooftop Solar Installations in India?

Wish to purchase high performing solar panels?

Talk to our Expert team – Send a note to sourcing@solarmango.com

Skip to content

Skip to content

Hello Sir

I want to know about the process to be followed for one Mw solar pv plant in South haryana. The land is already acquired ; self Finance available is 2 crore. the space is about 9500 sq.m

The purpose of plant is commercial ;the generated power to be sold to state govt.

is this required to be a registered firm for the same

Dear Deepak,

Mail us at sales.india@ikaros-solar.com for all the answers to your queries

Since wind and solar have similar cost structures and CUFs, will the IRRs be the same for both?

My IRR, will that increase if the entire project is equity-funded?

Sir

Our co is interested in a 5 MW solar farm for our own needs.

We want to know about use of trackers.

Does addition of trackers improve my IRRs?

dear sir

what do banks want for project/equity IRR give us a loan?