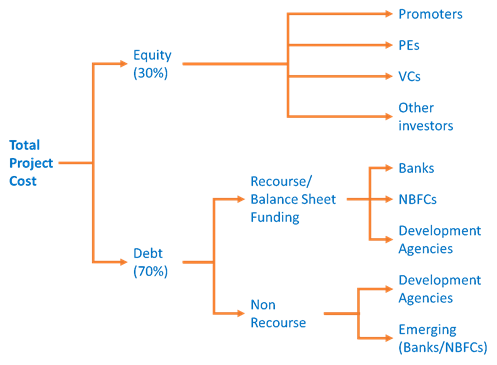

Sun’s energy is free but setting up a MW Solar plant is capital-intensive. Financing options is one of the biggest hurdles faced by MW solar plant investors. It is critical to select a solar financing option that suits your company. The usual cost of setting up a plant comes to around 6 Crores/MW. 30% of this is met by equity and the rest through debt financing. Equity is just a fancy word for having to fund from your own resources or from other investors. Debt financing is usually available with recourse, i.e., the investor will have to submit a collateral security against the loan he plans to take. Debt financing without recourse is an option only for big players with large scale solar installations and with a good track record. MW solar plants, in India, are financed by a debt-equity mix. The chart below gives an understanding of the solar financing options for a MW solar plant in India.

In order to obtain loans (debt financing), an investor can go for domestic or international solar financing solutions.

- Domestic Financing (mainly from banks): As of 2015, Indian banks are lending at interest rates in the range 11-13%, NBFCs could be lending at slightly higher rates. IREDA (the Indian government’s renewable energy lending arm) lends at lower rates (10.2-11.4%). Collaterals required for eligibility could vary all the way from 20% for entities such as IREDA to the full 100% for many banks. Domestic loans are usually for a period of 7-10 years, though many Indian banks are now comfortable to lend until 15 year tenures.

- International Financing: The final interest rate here for loans from international sources usually is between 8-10%, after factoring in all costs, including the cost of hedging for exchange risks. But here the time to process the loan would take a long time, around nine months and this could impact the project start time. Although interest rates are generally lower in the case of foreign financing, it is necessary to take into consideration the cost of hedging against currency fluctuations. Foreign debt is available for a tenure of 16-18 years.

There are certain criteria that the investor has to meet in order to be eligible for a sanction of loan. A few of them are listed below:

- Positive cash flow from operations in the company

- Company debt should be less than 40% of its net worth

- DSCR (Debt Service Coverage Ratio) of the company should be greater than 1.5

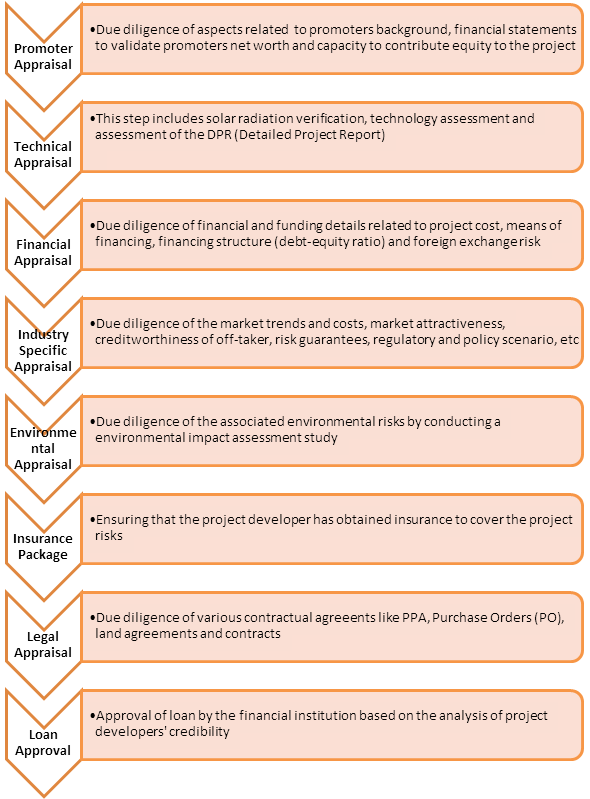

What are the steps for financing and funding a solar project?

Source: http://www.solarguidelines.in/

Is it possible to procure low interest financing for MW solar? If yes, what are the terms and conditions?

- One scenario where this is possible is if the financing is obtained from foreign sources, especially if the components used are also imported from the lending country. Therefore DCR (Domestic Content Requirement) projects will typically not be eligible. If the project is financed internationally, the interest rates are likely to be 8-10% including hedging.

But, financing will only cover part of the project cost, typically panels. Funding for the rest of the project will still need to be raised. Moreover, time to process the loan application is in the range of 6-9 months, which can impact financial closure/project start time. Due diligence cost can be high, making it viable only for plants of large capacity (greater than 10 MW). Moreover, repayment is exposed to foreign exchange rate fluctuation. Hedging is necessary, but will add to the cost (as much as 6% to loan interest rate). Additional terms may be imposed, such as use of shipping lines from the lending country, which can further add to the cost.

- Some NBFCs such as IREDA (Indian Renewable Energy Development Agency) provide low-interest loans for financing solar power projects in India. For example, grid-connected solar PV projects can avail interest rates of 10.2 -11.4% depending on the grading (Grade I, Grade II, Grade III or Grade IV) of the project.

One of the attractive aspects of IREDA financing is that the collateral to be provided securing the loan is only 10-33% of the loan repayment amount which is considerable low in comparison to what a bank provides. It should be noted that IREDA provides financing for any project with a minimum debt requirement of Rs 50 Lakhs, based on their techno-commercial viability.

What are the documents required to apply for loans?

The following documents are to be produced by the investor while applying for the loan:

- PPA

- Feasibility study

- PC contract

- Quality and safety standards followed

- O&M contract

- Evacuation

- Contracts for supply of components

- List of permissions and compliance acquired/to be acquired

Related Articles

Skip to content

Skip to content