Themes in this post: Prominent pioneers | Solar startups | Drop-outs

I have been highly fortunate as I started working in the solar power sector right from the start. This early involvement gave my team and me many opportunities to connect & interact with a range of pioneering companies, entrepreneurs & innovators.

When I think of solar industry pioneers, two companies who had contrasting fortunes come to my mind. In some ways, this duo represent the contrasting fortunes of pioneers in the Indian (and to some extent global) solar power sector.

In 2014, I had a meeting with Jigar Shah in New York, who was a co-founder of SunEdison. For the meeting, he had to tear himself away from his house not far from the spot of our meeting, as he was assigned the important task of taking care of his baby. Jigar, born and brought up in the US, and armed with prestigious degrees from University of Illinois & University of Maryland, cofounded SunEdison along with Claire Broido Johnson in 2003. SunEdison pioneered what is now referred to as the OPEX model where it sold rooftop solar power as a service so that a company could use its rooftop to generate solar power without having to make the upfront investment. #HMEMC acquired Sun Edison#H in 2009 for $200 million, in one of the global solar power sector’s first successful startup acquisitions. Pioneering certainly had paid here.

In 2017, I had another meeting with a solar industry pioneer, this time in Noida, Uttar Pradesh. I met the leadership team of IndoSolar in order to assist them on some strategic changes they were planning. IndoSolar was founded by RK Gupta in 2005 and by 2017 had India’s largest solar cell manufacturing capacity (about 200 MW). However, when I met them, the company was already in steep decline, despite the fact that India’s solar power installations had started accelerating significantly. The company’s decline was owing to multiple factors, only a few of which were in the promoters’ control. The company ultimately had to go through a bankruptcy proceeding, post which Waaree Energy acquired its assets as part of the corporate insolvency resolution process.

What a different fate each of these two pioneers faced!

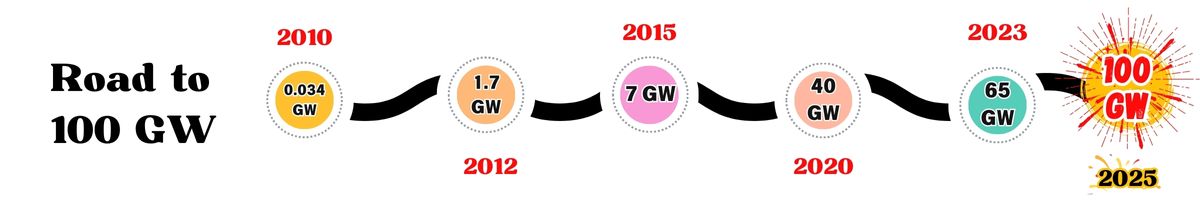

As we stand in 2025, the solar power sector is seeing more of the conventional businesses investing in it – the sector is fast becoming mature. But in the 2010 and 2020 period, especially 2010-2015, there were a number of individuals and businesses who made pioneering efforts and offerings in the Indian solar energy sector.

Not everyone succeeded, but almost everyone had a role to play. Let’s look at some of the prominent pioneers and innovators.

Pioneers

The solar energy and power sectors have witnessed pioneering efforts for quite some time now. While we mostly get to read about exciting innovations such as transparent solar panels and glistening building integrated solar PV, the real pioneering efforts with impact are perhaps quite different in nature and context – many of them are not so sexy in terms of optics, and a good many of them flew well under the mainstream media’s glare.

Take for instance the efforts of the social enterprise SELCO. I would consider the efforts of SELCO as really pioneering. Founded way back in 1995 when few Indians had even heard about solar panels, SELCO has focused on providing small scale #Hsolar solutions to underserved communities#H, emphasizing social impact. But its pioneering efforts were not centered around product or technology. The company developed innovative financing models and products tailored for rural households, and this was the core of its effort that successfully deployed solar energy systems in over 2 million households across the country.

There were other early pioneers who rarely get a mention in the press. Auroville, that exotic international commune next to Puducherry, had a solar power system installed in 1991. It was a 36 kWp stand-alone system installed at Matrimandir. At such a time, a 36 kW is a pretty substantial capacity. What made the Aurovilleans get the solar power system up and running was a mix of their hippy nature and the overall alignment of that locale and culture to sustainability.

While the above two were working in domains and/or geographies that mainstream media hardly highlights, there were other pioneers who were in the limelight, and sadly not always for the right reasons. Indo Solar and Moser Baer belong to this category.

Both Indo Solar and Moser Baer bravely invested in manufacturing of solar cells when very few Indian companies were even assembling cells into panels, let alone making cells. Moser Baer’s solar division, founded in 2007, had about 150 MW of cell capacity which included both crystalline cells and amorphous silica cells (the latter was something very few companies even worldwide invested in). Indo Solar, founded in 2005, grew to have about 200 MW of crystalline silicon solar cell capacity. For various reasons, only some of them being in their control, the two firms had to fold up. But there is no denying that these two had the pioneering spirit to invest pretty large money and efforts into a sector that was in its very early days.

And there are the successful pioneers.

Tata Power might be a household name in the Indian power sector, but its solar division can be considered a pioneer too, having started its investment fairly early in the Indian solar power sector. Then called Tata BP Solar as it had a JV with BP, the company started a 3 MW solar manufacturing facility #Hway back in 1991#H! In fact, Tata Power initiated its solar journey by developing rooftop solar systems and large-scale solar farms, and has installed over 3 GW of solar power plants since then. Originally a company that was into conventional power alone, the company has also considered it important to diversify energy sources and include renewables as a significant part of the energy mix.

ReNew Power, a relatively later entrant compared to the Tatas (started in 2010), can still be considered a pioneer too as it was perhaps one of the first pure entrepreneurial plays in the solar IPP sector with ambitions to scale really big. ReNew Power has played a pivotal role in large-scale solar installations. It has attracted significant investments to expand solar capacity, and had, by mid 2024, commissioned over 10 GW of renewable energy capacity.

Special mention should be made about prominent Indian businesses such as Borosil which quickly recognized the potential to tweak their glass offerings and provide the Indian solar module industry with the glass covering the modules required.

Some international early entrants deserve mention too – iPLON, a German firm which was one of the first to get international solar power plant monitoring technology to India, and Ciel et Terre, the French firm which was the first firm to introduce floating solar solutions in India.

In addition to their core solar power solutions, many of these pioneers also developed innovative financing models like green bonds. New business models such as the #HOPEX models#H initiated by some of these pioneering firms made solar energy accessible to a wider range of consumers, including residential, commercial, and industrial users.

Startups

Until about 2015, there were not too many small solar businesses that could be called startups – most of them were small teams of entrepreneurs installing and maintaining solar power plants. I say that these cannot be considered startups if startups are also meant to bring forth significant amounts of innovation and speed to the ecosystem.

In the last ten years though, the Indian and global solar power sector has seen a number of innovative firms and has been benefitted by their innovations.

A good number of startups founded during this period were still installing solar power plants in some form, but they incorporated some innovative elements in the deal. Where many of these firms differed from a traditional small business was in the speed at which they scaled their solutions.

Some startups also started providing other solutions that were valuable to solar power plants, with large doses of IT & AI included in these. Prominent innovation themes in solar includes those in solar design, leveraging blockchain, asset management, inverters & power electronics, monitoring, financing, new types of solar panels such as solar tiles, advanced energy storage especially for rooftop solar, battery management systems (BMS), agrovoltaics, solar farm O&M solutions and solar power trading,

India has seen a further acceleration in startups related to solar energy since 2020. Since then, the characteristics of startups in the solar energy sector have also undergone a significant transformation, with a significant emphasis on the use of digital and related technologies for O&M, performance enhancement and asset maintenance for large solar power plants. Technologies all the way from IoT, robotics, drones and a liberal dose of AI have been leveraged by these startups.

The profiles of startup founders have also undergone a significant change in this period. While most startup founders in the 2010-2020 period had a power engineering or energy sector background, a good proportion of solar energy startup founders since 2020 have diverse backgrounds, with digital and IT skills playing a prominent part.

Prominent solar power startups include Freyr Energy, SolarSquare, ZunRoof, Illumine-i, Fourth Partner Energy, CleanMax Solar, Oorjan Cleantech, Cygni Energy, U Solar, Roofsol

Fourth Partner Energy, founded in 2010, specializes in providing turnkey rooftop solar solutions. Developed a portfolio of about 1.5 GW across solar and renewable energy projects. Expanded operations to countries like Sri Lanka and Vietnam.

CleanMax Solar, founded in 2011, provides rooftop and open-access solar solutions. Secured significant funding and has installed over 800 MW of solar capacity.

Oorjan Cleantech, established in 2014 by IIT Bombay alumni. Offers rooftop solar solutions and assists customers with financing options. Operates across 14 states in India.

Cygni Energy provides innovative energy storage solutions for many verticals including solar power.

Freyr Energy, Solar Square & Zunroof provide residential solar power (rooftop solar) solutions, but backed by well-built systems and processes, and effective use of IT & digital solutions.

Startups such as U Solar and Roofsol also provide similar a mix of solar installation solutions, but mostly around distributed (rooftop) solar.

Illumine-i, a startup headquartered in Chennai, provides solar and renewable energy design support solutions to developers and EPCs in the US and other international markets.

There are a number of other small and innovative firms developing some lovely solutions.

Working in the intersection of digital and physical, many drone companies also offer their drone solutions to monitor solar and wind farms. Using a combination of AI & digital technologies, these drone solutions enable solar farm developers to acquire land faster with drone surveys, make solar farm construction more efficient with AI-powered reports and maximize yields of solar power plants through advanced solutions for dust and fault detection algorithms. Here is the offering from Skylark Drones for the solar power sector.

Or consider WindStream Tech, which develops the cool-looking SolarMill, a combination of vertical axis wind turbine and solar panels. The SolarMill is thus a solar-wind hybrid solution that is company and hence can be installed on rooftops, mobile units etc. Rooftop wind turbines have not grown fast in India as many of them are horizontal-axis wind turbines that have challenges in providing good electricity yields under normal Indian urban wind conditions. But vertical axis turbines perform better at low-wind speeds, and combining these with solar panels give you a bigger bang for the buck! You can see a short video of the Solar Mill in operation here.

Drop-outs

The journey to a solar future isn’t always smooth sailing, at least not for all.

It should not be any surprise to have flame-outs in an energy industry such as solar power. The Indian solar power sector has indeed been a witness to many flame-outs, some of them prominent and many much less also.

Some of the failures happened because they were too early or the challenges were much more stiff than they had imagined. But a few others who failed would perhaps regret that they had not thought and planned better. Prominent among them are IndoSolar, Moser Baer & Lanco Solar.

Moser Baer Solar, one of India’s early solar pioneers, was involved in #Hboth crystalline silicon and thin-film#H solar technology. The company faced financial challenges and high levels of debt owing to delays in receiving incentives and subsidies, and because of severe competition from cheaper domestic and international manufacturers of solar cells and panels, especially Chinese companies. The combined assault of these challenges led to its bankruptcy and exit from the solar sector.

Indosolar, #Hone of the first solar cell manufacturers#H, was reliant on government incentives and domestic demand. It faced challenges on both these dimensions. But in my opinion, what affected Indo Solar most was the lack of demand from the Indian market – with import duties still keeping Chinese solar cells cheaper, most Indian solar panel makers were buying cells from China.

Lanco Infratech, a diversified infrastructure company with significant investments in large-scale solar projects was also a prominent failure. Lanco was one of the first Indian companies to attempt investing in the upstream of solar PV value chain – in manufacturing polysilicon & wafers. I remember writing about it in a blog post way back in 2011. Nothing much came out of these efforts though – it was way too early and way too ambitious to try to compete in a sector with high capital costs, challenging global competition characteristics and also less than optimal government support for such risky ventures. All of Lanco upstream efforts had to be shelved, and the group itself declared insolvency in 2017.

Another prominent drop out in the Indian solar power sector is Sun Edison, though this was owing to the international bankruptcy of the global firm. Yes, this is the same Sun Edison that I mentioned in the beginning that was sold for $200 million and made its co-founder Jigar Shah a wealthy man. But that was in 2009. Subsequently, through a series of corporate manoeuvres, it became one of the world’s leading renewable energy firms. Its Indian arm too, headquartered in Chennai, was a prominent face in the Indian solar power plant development sector. However, a combination of super aggressive expansion & acquisition plans and financial missteps led to a fast fall from grace for the global leader. The Sun Edison group, headquartered in the US, declared bankruptcy in 2016, and its Indian arm too soon followed with its asset liquidations. Greenko bought most of Sun Edison’s solar assets.

Beyond what I have briefly mentioned, I’m not going to get into the details, specifics and my opinions of why the above flame-outs happened. Depending on whom you talk to, you might get different versions! Without a doubt, when you dig deep into any business failures, you will find many things that “more than meets the eye”. Regardless why they shut shop, in my mind they are pioneers because they tried doing something valuable ahead of many others.

Skip to content

Skip to content