Themes in this post: Making solar firm | Scaling utility solar | Scaling rooftop solar | Strengthening solar manufacturing sector | Learning from China

The energy needs of India’s economy and society are poised to increase at a dramatic pace during the next two decades. It is going to require quite some scaling to make the fast-growing energy needs of India’s industry & society to be contributed by renewable sources.

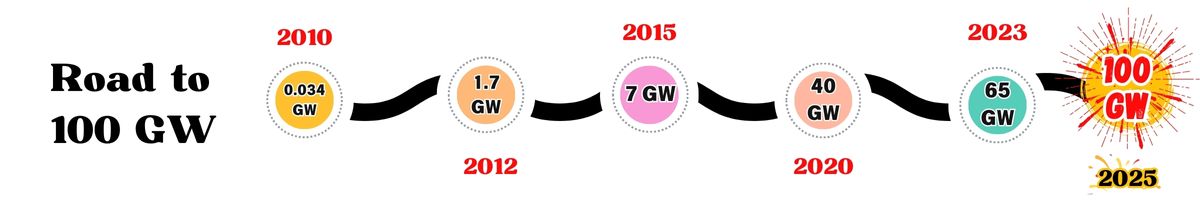

The Indian government’s target is for India to have #H500 GW of renewable by 2030#H. Of this, one can expect solar will contribute 250-300 GW (50-60% of total) – 2.5-3 times what it was at the start of 2025.

Suppose we do a great job over the next ten years? How much could solar be contributing to India’s electricity needs by 2035?

As of January 2025, India’s total electricity #Hinstalled capacity is about 470 GW#H. Estimates suggest that it could be about #H1400 GW by 2035#H, almost a trebling of the current installed capacity.

Is it possible to get solar power capacity to well over 500 GW by 2035 – possibly about 650 GW by 2035? At such a capacity, solar power could be supplying between 25 and 30% of our electricity requirements and inching closer to coal power generation – an impressive feat.

If solar power in India has to reach these levels of magnitude, what needs to be done?

There are six aspects on which efforts are critical:

- Making solar firm

- Scaling utility solar faster

- Growing rooftop solar

- Leveraging other renewables

- Strengthening the solar manufacturing ecosystem

- Learning from China

Making solar firm

Solar energy is an intermittent source of energy – there is little anyone can do about this, unless you have fanciful notions of tinkering around with the earth’s rotation.

When the sun isn’t shining bright enough on a day, or during nights, how do we ensure that users relying on solar still get its power?

Unless we are able to get solar power to a state where it is available far more reliably, there is no way you can scale solar power to 500 GW and higher.

Fortunately, there are several key technology avenues that India can explore to make solar power more dependable.

Using batteries

Adding grid-scale battery storage or utilizing pumped hydro storage buffers the fluctuations in solar power, ensuring a steady energy supply. These systems mitigate the impact of intermittent solar generation, providing a reliable backup during periods of low solar output. In the last few years, the Indian government is actively promoting the installation of storage systems alongside solar projects, particularly in strategic locations, to support peak demand periods and improve grid stability.

Advances in battery technology have increased energy storage efficiency. Modern batteries offer higher storage capacities, allowing for more significant energy storage and longer discharge periods. The cost of battery storage systems has been decreasing, making them more accessible and economically viable for widespread use. Innovations have led to batteries with longer operational lifespans, reducing the need for frequent replacements and lowering overall costs. Batteries are increasingly being integrated with smart grid technologies and energy management systems, enhancing their functionality and efficiency.

There are some key challenges for the use of batteries. Initial costs for purchasing and installing battery systems remain high, posing a financial barrier for many consumers and businesses. Batteries degrade over time, leading to reduced storage capacity and the need for eventual replacement. Proper disposal and recycling of batteries are essential to prevent environmental harm, but infrastructure for this is still developing. Current battery technologies may not provide sufficient energy density for all applications, limiting their effectiveness in some scenarios. Dependence on specific materials, such as lithium, can lead to supply chain vulnerabilities and increased costs.

Regardless of the challenges that large-scale use of batteries pose, battery technology will likely contribute the most to solar power storage over the next decade.

Solar-wind hybrids

An interesting avenue that is already being tried out by India is the use of solar-wind hybrid systems which leverage the complementarity of solar and wind energy (when sun shines there is little wind and vice versa). Such #Hhybrid systems can reduce energy variability by 20-30%#H, enhancing reliability and making solar power a firmer energy source. In states like Tamil Nadu and Gujarat, hybrid solar-wind farms have demonstrated higher energy output stability, improving grid compatibility and economic viability.

Solar and wind energy have complementary generation profiles. Solar power typically peaks during the day, while wind energy can be more abundant during early mornings, evenings, and nighttime. This synergy reduces periods of low energy generation. Hybrid systems can reduce energy variability significantly, as mentioned earlier.

While the idea of solar-wind hybrid is not new, there were few attempts to implement MW-scale hybrid power plants. Post-COVID, I’m seeing a lot more thrust in this direction. Large renewable power developers such as ReNew Power, Tata Power and Adani Green are implementing several hybrid power plants in states such as Tamil Nadu, Andhra Pradesh and Gujarat.

In addition to less variability in power output, solar-wind hybrid power systems also optimise land use by utilizing the same land for both solar panels and wind turbines, enhancing the overall productivity of the solar farms. Estimates suggest that hybrid farms, over a year, can achieve up to 20% increase in energy generation per hectare compared to standalone solar or wind projects.

India’s strategy for solar-wind hybrid power plants are still evolving, but there are some highlights already visible.

India had about 1.5 GW of wind-solar hybrid farms installed as of early 2024. The Solar Energy Corporation of India has developed project development guidelines for streamlining solar-wind hybrid projects.

At the state level too, states such as Karnataka, Tamil Nadu, Telangana and Rajasthan have taken initiatives through special incentives or pilot projects for these hybrid projects.

Making the grid work for firmness

Another way of tackling infirm power is to work around with the grid so that it can absorb and work under infirm solar power conditions.

One way to do this could be by leveraging smart grid technologies that utilize advanced metering infrastructure and real-time data analytics to monitor and manage energy resources more effectively. This enhances the integration of variable solar and wind energy into the grid, allowing for automated adjustments that balance supply and demand efficiently. Implementing smart grid technologies in states with high renewable energy penetration enables real-time monitoring and management of energy flows, ensuring stable and reliable power distribution.

Creating efficient interstate transmission systems to facilitate transfer of renewable energy from production hubs to consumption centers could be another way to ensure that power generated in one region can be effectively utilized in another. Developing interconnected transmission lines between states with high solar generation and those with high energy demand ensures that excess solar power is transmitted efficiently, reducing wastage and enhancing grid stability.

Another way to adapt the grid and the power ecosystem to infirm and variable power energy output from solar power plants is through the use of demand response programs. Shifting electricity consumption to align with peak solar generation through demand response programs can optimize energy usage patterns. This reduces the load on the grid during non-solar hours, balancing supply and demand more effectively. Such programs also incentivize industrial and residential consumers to adjust their electricity usage based on availability, ensuring that energy generated during high solar periods is utilized efficiently.

Scaling utility solar further

Utility scale solar has to play a major role in getting solar to 500 GW and beyond, but like any ambitious project, it has a few speed bumps to navigate.

Key challenges for the growth of utility scale solar farms in India are availability of large tracts of land, financing challenges for select projects, high dependence on imports and hence exposure to price volatilities (especially for cells and modules from China) and the increasingly important challenge of ensuring smooth export to the grid.

Policies for growth

India has had fairly robust policies for over a decade to grow the utility scale solar sector. Many of the policy elements – capital subsidies, tax breaks, viability gap funding etc. – are no longer needed for the growth of this sector.

What will be needed will be forward thinking policies that can scale it from the current 80 GW to something like 250 GW by 2030. For this, you might need to think about policies differently – as the saying goes, “what got you here will not get you there”.

Specific policy levers that can be used for this kind of scaling could be strengthening long term PPAs and making them a win-win for all stakeholders, policies that streamline land acquisition for large solar parks etc.

Strong transmission infrastructure

Scaling from 80-250 GW will surely entail many more solar parks.

These large solar parks will likely be located in fairly remote regions – because this is where you can get land parcels worth a few thousand hectares! But how do you get this power to cities and industrial regions? You need a strong transmission infrastructure, something that has not been lost on the government – work has started in building green transmission corridors, but these efforts could perhaps be accelerated.

Solar power is likely to be available in abundance – and perhaps in surplus – in states like Rajasthan, while states like Maharashtra might desire a lot more of this green power. One way to match this demand – supply equation is to have interstate transmission of solar power in which both states (in this case Rajasthan and Maharashtra) benefit. Transmission will again play a role here – interstate solar power transmission, which is now allowed, though it is early days and a number of teething problems need to be ironed out.

Tech levers

Technology and innovation levers that can be used to grow utility scale solar power plants in India include promoting the use of bifacial panels and efficient solar panels, enabling intelligent use of energy storage systems that grows the grid along with the growth in solar power, and smart monitoring to optimize the performance of solar plants by enabling predictive maintenance and efficient energy management.

Other levers

Other levers that can be used to grow utility scale solar power plants in India include smart use of Public-Private Partnerships (PPPs) to streamline project development and financing, financial innovations that can facilitate cost-effective financing for large scale solar farms, and identifying other useful strategies from the successes & challenges of the first few solar parks.

For challenges such as land availability, some creative thinking and lessening government bureaucracies can make a difference.

Financing challenges are becoming less challenging for projects where developers and power offtakers have credibility. Projects with uncertainties such as floating solar power projects will still require some risk taking and creative financing from the investing community.

The Chinese dependence is a challenge that is unlikely to go away immediately but the real solution is perhaps the simple but hard pathway – painstakingly building a powerful Indian manufacturing ecosystem with enough determination with a good dollop of shrewdness to beat China.

Growing rooftop solar

The rooftop solar segment performed far below the intended targets set for 2022. Despite multiple efforts, the sector has fallen short of expectations. The target was 40 GW for rooftop solar installations by 2022, while by the end of 2024 it was only around 15 GW.

Both the central government and many state governments were keen on getting large installed capacities of solar power being deployed, and thus focussed mostly on developing utility scale solar power plants.

In addition, regulatory hurdles, including complex approval requirements and lack of streamlined policies, have made the adoption of rooftop solar challenging. These bureaucratic obstacles have deterred small commercial entities and residential customers from installing rooftop systems, which in turn has hampered the sector’s growth.

The high initial costs associated with rooftop solar systems are another significant barrier, particularly for individual homeowners and smaller commercial players. While financial incentives such as subsidies exist, access remains limited, and awareness of these benefits is generally low in rural and economically disadvantaged areas. Small businesses and residential sectors, where rooftop solar has high potential, often face difficulties in securing affordable financing, dampening growth.

Given all these, it should be no surprise that India’s rooftop solar performance has been mediocre compared to the growth of utility scale solar power plants. But this does not mean rooftop solar should play second fiddle to ground-mounted solar power plants. Solar power is at the core a distributed energy source, and generating it where it is used makes a lot of sense!

While some attempts have been made especially by the central government in overcoming challenges to the growth of rooftop and distributed solar power plants, a lot more can be done.

Policy levers

Specific policy levers that can be used to grow rooftop solar in India include incentivizing Net Metering that encourages more consumers to adopt rooftop solar by allowing them to feed excess energy back into the grid and receive compensation, strengthening and making Long-Term Power Purchase Agreements (PPAs) a win-win for all commercial & industrial stakeholders, coming up with innovative and effective state government schemes like the central scheme #HPradhan Mantri Kisan Surya Yojana#H to support farmers and residential users in installing rooftop solar systems.

The #HSurya Ghar program launched in 2024#H is indeed an inspiration. Loaded with significant financial incentives, within a year of its launch, it has reportedly racked up a few hundred thousand rooftop installations.

Tech levers

Technology and innovation levers that can be used to grow rooftop solar in India comprise use of bifacial panels that could increase electricity output per unit area, smarter inverters with better monitoring capabilities, and leveraging technologies such as Blockchain that can drive distributed solar through peer-to-peer sharing of solar power etc.

Other levers

Other solar power ecosystem levers that can be used to grow rooftop solar in India include community engagement for awareness and action, developing a skilled installer base that can also provide effective maintenance for rooftop solar, getting better discom participation to promote rooftop solar, and innovative financing mechanisms that make it easier for people to invest in rooftop solar.

Leveraging other renewables

The growth of solar energy has certainly taken the lion’s share of funding and policy support, but that doesn’t mean wind, biomass, and hydro can’t still thrive. In fact, when we get the balance right, solar can be the perfect teammate to other renewables, making the energy mix stronger, more reliable, and less prone to intermittency, creating a win-win for all.

So, how do we make sure that solar power’s ascent also grows other renewables, and in turn this helps the solar sector grow even better? There are some effective avenues – from hybrid systems that combine solar and wind (already discussed), to shared infrastructure that optimizes grid resources, there are plenty of ways to make sure solar shares the stage. With smart policies, better grid integration, and some collaborative spirit, we can make sure all renewables get their time to shine.

In this context, diversified renewable portfolio standards can be promoted to procure a mix of renewable energy sources, not solely solar. Countries such as Germany are attempting this.

Higher allocations in government funding to R&D initiatives for non-solar renewables can help identify ways for wind and biomass to scale better, and at least partly in collaboration with solar power.

Investing in grid infrastructure upgrades to accommodate multiple renewable energy sources without bias could be another way to promote other renewable energy sources. The government’s Green Energy Corridor initiative, which aims to build dedicated transmission networks for renewable energy could enhance the viability of both solar and wind power projects, for instance.

Shared grid infrastructure can be established for multiple renewable sources to improve efficiency in energy distribution and reduce operational costs. For instance, Spain has successfully integrated multiple renewable sources into shared grid systems, optimizing resource use and enhancing the efficiency of energy transmission. Spain had a remarkable #H60% of its electricity from renewables#H in the first half of 2024.

Strengthening solar manufacturing

If India wishes to be a solar superpower, it needs to be self-sufficient in the core components that make up a solar power plant. It is painful to imagine a future where India installs 50 GW of solar power a year but is dependent on Chinese panels to meet these stiff targets.

We thus need to find a way in which we can build a powerful manufacturing ecosystem not just for panels, but also upstream items such as cells, and wafers and finally reaching the very top – polysilicon.

India’s domestic manufacturers struggle to match the lower costs offered by global solar producers, particularly from China. Due to this, solar power plant developers in India often prefer to source components from China to reduce overall project costs, which continues to hold back growth in the domestic solar PV manufacturing sector.

While there have been policy efforts aimed at encouraging solar manufacturing, the focus has largely been on installation targets rather than building a sustainable manufacturing ecosystem. The National Solar Mission set ambitious goals for capacity installation but provided relatively limited direct incentives for local manufacturing. Additionally, a lack of consistency in policy implementation and support for domestic manufacturing has led to uncertainty among potential investors.

The Make in India initiative, launched to boost domestic manufacturing across various sectors, includes solar PV manufacturing as a priority area. However, progress in scaling solar PV manufacturing has been limited, especially in the upstream segment. The initiative aimed to promote local production through incentives and policy support, but challenges such as high setup costs, limited infrastructure, and competition from cheaper imports have hindered significant advancement.

Institutions like the National Institute of Solar Energy (NISE) have also made efforts to promote research, innovation, and capacity building in solar technology. For instance, NISE has focused on developing bifacial solar panels, which can increase energy capture by utilizing both sides of the panel. However, despite such research initiatives, the lack of commercial-scale manufacturing and limited investment in research and development (R&D) facilities have restricted the practical impact of these innovations on the broader solar manufacturing market in India.

For polysilicon & wafers

Currently, almost all of India’s polysilicon and wafer needs are met through imports, primarily from China. This reliance leaves India vulnerable to supply chain disruptions and price fluctuations. The solution lies in boosting local manufacturing. With the right policies and industry intent, India can become a sizable player in the global polysilicon & wafer markets.

It’s not easy, but it can be done.

For polysilicon and wafers, some estimates suggest that #Hmanufacturing costs in India are 30-50% higher#H than in China due to economies of scale, less established supply chains and higher electricity prices.

Scaling in polysilicon and wafer production will not be easy, but the government of India needs to make a start. It can offer significant financial incentives to establish local polysilicon and wafer manufacturing facilities – I’d suggest a lot more than what are being offered right now. One way could be to tweak the PLI scheme to provide more liberal incentives for investors in polysilicon & wafers doubling down on domestic content requirement even if some portions of the industry are against it, and providing long term government purchase contracts for producers of domestic polysilicon and wafers, and helping investors with low cost financing and subsidized power cost.

Other levers that can be used to grow polysilicon & solar wafer manufacturing sectors in India include developing collaborative ecosystems and international partnerships, including PPPs to reduce risks for private investors, international JVs (even with tech leaders such as Dow & Siemens can be considered), establishment of innovation & R&D hubs.

For solar cells & modules

Right now, India imports a significant portion of its solar cells and modules, which can expose the industry to supply chain risks and price volatility.

We might soon be self reliant on module production given the fairly high manufacturing capacity, but cell production capacity in India still needs correction upwards.

How can this be accelerated?

While the obvious route could be the Indian industry investing heavily into manufacturing like China did a couple of decades back, the returns from investments are uncertain given the Chinese dominance of the sector and the resulting preference for Chinese cells by Indian solar module makers. This then brings into the picture the government, which should somehow regulate what Indian solar module makers can buy. But such regulations might not be aligned to the free trade principles of World Trade Organization, of which India is a member

As you can see, the solution has to be more nuanced.

Domestic manufacturing costs for cells are approximately 20-30% higher than those for China. One way to mitigate this could be to develop manufacturing clusters with shared infrastructure, such as logistics and testing facilities This can create economies of scale, attract investments, and streamline supply chains.

Implementing protective measures such as import duties on solar components, similar to the existing Basic Customs Duty (BCD) on solar cells and modules could be another lever.

A related lever is the use of Domestic Content Requirement (DCR). Under this, it can be mandated that a certain percentage of solar components used in projects must be sourced locally This is already being done for solar modules by the Indian government, with the #HALMM (approved list of modules & manufacturers)#H that certify and incentivise Indian production of solar modules, and this will be extended to cells as well in future. So, one could say that the government has already some robust steps to strengthen the Indian solar manufacturing sector.

Finally, for growing the solar cells and modules manufacturing ecosystem, the government could help local manufacturers gain access to international markets. Here the government of India should leverage trade agreements and improve the competitiveness of Indian BoS components for export markets. With quality improvements, Indian manufacturers can target markets in Africa, Southeast Asia, and Europe, increasing their global footprint.

For balance of systems

When it comes to solar energy, the Balance of System (BoS) components – such as inverters, mounting structures, and other essentials – are the unsung heroes. While these components are critical for solar systems, their growth presents an exciting opportunity for innovation and local manufacturing.

While a significant emphasis of the manufacturing portion of the solar policy has been on encouraging the growth of solar panel & cell making in India, there has been relatively less policy focus on BoS manufacturing. BoS such as mounting structures, as well as panel components such as aluminium frames are already made in India, as is the glass for solar panels. But production of BoS such as inverters still could use favourable policies.

Currently, while some BoS for Indian solar power plants such as mounting structures are made mostly in India, components such as backsheet that go into making of the panels have import dependencies. By strengthening the BoS manufacturing ecosystem in the country, India can do a lot of good for the country’s power plants as well as exports!

Some of the policy levers used for solar panel & cell production – such as PLI schemes and duty protection could be explored for BoS as well.

Another lever could be developing clusters for solar manufacturing. These clusters create economies of scale and attract investments by providing a shared ecosystem of suppliers, logistics, and testing facilities.

Learning from China

China has rocketed to the top of the solar power industry with precisely the same approach that it had in many other industries. It was a mixture of bold targets set with aggressive policies to sustain these, large resources allotted, and caring little for the rules that the rest of the world followed and expected others to follow.

In essence, China played by its own rules. Whether it was the right and fair thing to is debatable, but it is now fait accompli.

China is here to stay; it’s big; and it’s a big threat to many economies including India, and also in solar power.

What can India – or for that matter any country – do about China? We can complain long and wide about a number of things that just doesn’t seem fair, but does it take us anywhere?

China’s solar growth

China was nowhere on the solar power radar in 2000. Then, China had low solar power installed capacity, with practically nothing to show for a solar manufacturing ecosystem. Fast forward to today, and China stands tall, in both solar power capacity and in manufacturing.

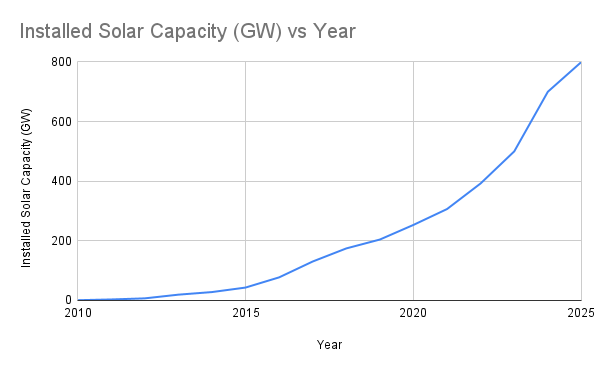

From almost nothing in 2000, China had reached a respectable 10 GW manufacturing capacity by 2010, and then pressing the levers furiously, has gotten to have about 800 GW of solar manufacturing capacity by end of 2024, an astonishing #H80% of total global PV manufacturing capacity of 1100 GW#H.

On installed capacity of solar power plants as well, the growth story is similar. From nothing in 2000 to just 1 GW by 2010, it has reached a humongous 800 GW of solar power installed capacity by end of 2024, out of about 2200 GW (2.2 TW) in total for the whole world – an impressive #H35% of all the world’s solar power capacity.#H

Figure: China’s Installed Solar Power Capacity

What powered China to #1?

But how did China transform from a solar underdog to global solar champ?

Topmost among the reasons for China’s dominance is its government. Regardless of how the the Chinese government tries to spin it, there is no denying that it used every possible trick in the book to get the country to the top of the solar league. As with many other sectors, the Chinese government and industry were quite “flexible” in the way they interpreted innovation and legal protections and quickly absorbed technologies and innovations from around the world.

Their policies and initiatives included subsidies and incentives, incorporation of solar power sector growth as a key ingredient in their 5-year plans – the “Golden Sun” program, integrated into the Five-Year Plans, provided substantial funding and support for large-scale solar projects. Also in the list of incentives were attractive feed in tariffs that guaranteed profitable returns for solar electricity producers, and Production-Linked Incentive (PLI) schemes that made a significant difference to the solar manufacturing value chain, such as polysilicon, wafers, and cells.

With this kind of support, Chinese companies such as JinkoSolar and Trina Solar scaled up, slashing production costs, improving manufacturing efficiency, and integrating vertically. These firms were also adept at adopting and adapting foreign technologies to enhance their own manufacturing processes and product offerings, enabling them to innovate rapidly and improve the performance their offerings.

Many of the Chinese solar companies have become highly vertically integrated – making everything all the way from polysilicon to small offgrid solar products – and this has further enabled them to offer products at low prices and created serious entry barriers for entrepreneurs and business in the rest of world. Top Chinese firms like Trina Solar and JinkoSolar control everything from polysilicon production to the assembly of solar panels, enabling them to optimize each step and maintain competitive pricing.

China’s growth in solar mirrored its growth in many other fields that helped it to become the world’s leading manufacturing hub and also the world’s leading consumer of products.

Chinese growth was also aided by massive demand for solar cells and panels from the rest of the world, including India. Europe and USA initially imported most of the cells and modules from China before belatedly recognizing that their domestic solar manufacturing sector was dying, and imposing restrictions.

In parallel, China invested massively in their own R&D, ensuring that their solar power sector is at the forefront of technology worldwide. The country has established numerous research institutes and centers focused on solar energy innovation. The development and commercialization of technologies such as Heterojunction Technology (HJT) has improved the efficiency of Chinese solar panels, making them more attractive to consumers seeking higher performance products.

China also promotes significant #Hcollaboration between academic institutions and the solar industry#H through public-private partnerships. These collaborations facilitate technology transfer, joint research projects, and the commercialization of innovative solar solutions.

What should India’s solar strategy be to overcome the China factor?

Can India beat China in solar? If yes, what would such a winning strategy look like?

It is not easy to devise a strategy to beat China – ask the US whose economy is about 60% larger than that of China ($29 trillion vs $18.5 trillion GDP in 2024), but is struggling to find an answer to Chinese dominance in most fields!

One thing is clear: Whatever is the strategy for India to build a strong solar power ecosystem, it should be all-encompassing and massive – half-measures, like they have been happening last decade and half will not do.

On the manufacturing side, it is likely that some key elements of this strategy will include a more liberal PLI scheme, significant incentives for massive R&D upgrading, getting significantly higher international investor participation through a variety of measures and enticing them with China-plus template, and dramatic enhancement of collaboration and partnerships between various stakeholders.

On the developer side, it is critical to do everything possible to get solar to contribute a lot more to the grid by 2030 than what it does right now – this could mean investing significantly in upgrading the grid infrastructure, provide liberal incentives for battery integration, and putting a lot more muscle into digital and IT for evolving the grid really smart.

Simultaneously, the government should make big moves on the international scene. It should reach out far more aggressively to the key export prospects such as the USA, EU, Japan & South Korea and explore how together, this combination can prevail over China. This is indeed an opportune time to do this, as every company wants to have clear backup plan to China (called the #HChina-plus#H in trade lingo)

Lastly, India has a thriving startup ecosystem (the third largest in the world) and the government should tap into this powerful DNA and leverage this to get the country to be a leader in practical innovations for solar power.

Skip to content

Skip to content