Themes in this post: Banks | Other FI investment | Development finance | Equity finance | Other financing

Early in my work in solar power, I remember meeting Pashupathy Gopalan (popularly known as Pashu), who was then the CEO for SunEdison, at that time a prominent global solar power developer. SunEdison’s India headquarters were located in Chennai and I happened to bump into him quite a few times. When I heard that he had studied at Stanford, I first thought he had studied engineering there; but no, he told me that he done his MBA in finance at Stanford. This was perhaps the first time I discovered the strong finance connection for solar power plants.

Not long after, I realised this: the solar power sector has as much to do with financial engineering as it has to do with electrical, electronics, semiconductor and civil engineering.

Thus it should not surprise you that increasingly, CEOs of many solar power sector companies – especially developers of large solar projects – are those with a strong background in finance.

As the solar power sector matures further and scales to multiple terawatts worldwide and hundreds of gigawatts in India, building these in a sustainable manner requires significant capital and a fair bit of financial engineering. Whether it’s through equity investments that provide growth capital, debt financing that helps manage upfront costs, or the use of models like green bonds, the solar growth story in India needs strong support from the investment community.

Investments in the Indian solar power sector

A total investment of about 3 crores per MW will be needed for installing medium and large scale solar power plants and solar farms (50 MW and higher). The per MW investments needed for smaller capacities could be higher than these.

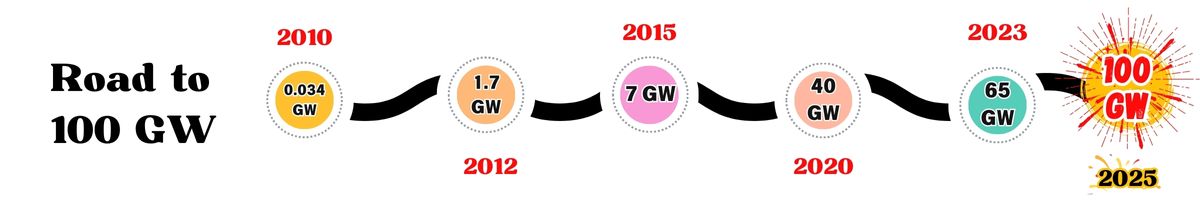

India installed about 25 GW of solar power in 2024 and it is expected to be about 35 GW in 2025.

The investments in the Indian solar power sector in 2024 alone had thus been upwards of Rs 75,000 crores, and in 2025, this will be over 1.1 lakh crore rupees.

Besides the project costs, other investments take place in this field as well – in the form of O&M expenses, costs to change inverters after a decade, insurance costs, training and education costs for both blue and white collar workers etc. But the largest share of costs (and thus investments in some form) will be owing to the project costs for installing solar power plants.

Annual investments in solar power plants have already overtaken that for new coal power plant capacity additions, and this trend will likely continue. A 2024 government report mentioned that between 2024-amd 2033 (10 year period), India will be investing about Rs 6.5 lakh crores in adding about 80 GW of coal power plants (at about Rs 8 crores per MW for a coal based plant). For the 2024-2033 period, India would have likely installed about 300 GW of solar PV capacity, at a total investment of about Rs 9 lakh crores, almost 50% more than that for coal!

Such massive investments in the solar power sector will need all types of financial instruments to play a role.

Types of financial investments

The Indian solar power sector has witnessed investments from most major types of financial instruments – across debt and equity

All the prominent financial investment vehicles are in full display in the solar power sector.

Among these, the prominent investment pathways have of course been the well-known equity and debt instruments.

Estimates suggest that #Hdebt financing might account for about 65%#H of the total funding in India’s solar sector. This should hardly be surprising as most of the commercial solar power plants are implemented on a model where about 70% is debt and the rest is equity from the developers. In the case of rooftop projects, some companies and domestic sectors might have put in 100% equity without resorting to loans. In some other cases, solar power plants could have been implemented based on donations from CSR funds and philanthropies. Outside of these, it is quite possible that most solar power plants would have been implemented on a debt+equity route.

As the solar power industry matured in the past few years, banks have been increasingly confident of advancing loans to solar power projects – even large ones – at rates being offered for mature sectors such as housing and conventional industry.

Besides traditional banks, there are other large finance stakeholders who have also become increasingly interested in the Indian solar power sector. These include multilateral development banks such as IFC, ADB etc..

On the equity side too, things are humming. #HIndia allows 100% FDI in renewable energy projects#H, making it highly attractive for global investors. Sovereign wealth funds, international equity investors and prominent asset management companies are investing and are keen to invest more in India’s growing solar market.

On the equity side, the solar power sector is just gaining traction. Venture capital and angel investors have also had a reasonably lower involvement in the solar power sector as many components of the value chain do not present exciting opportunities for them, but in the last few years, VC firms have started considering select innovations in O&M, solar asset management as domains worth betting on. Private equity usually are at the gates of an industry when it is nearing the growth stage and when the uncertainties (especially technical & policy uncertainties) are fewer. India’s solar power sector is right now at this stage, and thus I can see significant interest from the private equity sector as well.

Banks & solar

A number of banks are providing extensive support to the Indian solar power ecosystem. Here are some examples for both large projects and small residential solar power projects.

HDFC Bank issued a green loan to Adani Green Energy, specifically for funding new solar projects. The ₹2,000 crore green loan in 2023 enabled Adani Green to develop an additional 3 GW of solar capacity, adhering to stringent environmental standards.

SBI provided a Rs 2700 crore project loan to ReNew Power to support for a large solar power project in 2023, signalling an shift in interest for traditional Indian banks towards the solar power sector.

Many of the large solar farm projects are funded by a consortium of lenders, as the amounts can be quite large. A $400 million loan in 2024 for Adani Group’s 750 MW solar project was financed through a consortium of five leading banks. In 2022, Renew Power raised $1 billion through ECB (external commercial borrowings) from 12 international lenders, the largest of its kind until then.

For rooftop solar projects, depending on the type of project (small residential rooftop or large industrial rooftop), loans can be availed from different banks.

For instance for residential rooftop solar buyers, EMI based loans are available from banks such as the Surya Shakti Solar Finance from State Bank of India and HDFC. IOB has its own version in its Surya Loan. Home solar loans are also available from others which the user can access through solution providers such as Tata Power Solar. Here’s another partnership between Tata Power Solar & this time Indian Bank to provide finance under the PM Surya Ghar Muft Bijli Yojana rooftop solar scheme.

For commercial rooftop solar projects, in addition to loans, other financial models are also available – pay-as-you-go, leasing (financial or operational leasing), etc.

A number of NBFCs also operate in the Indian solar power sector financing – this list includes L&T Infrastructure Finance, SBI Caps, IL&FS Financial Services etc.

Though a bit dated, this 2019 illustration provides an idea of the types of lenders who dominate in the Indian solar power sector. An FY 21/22 analysis by JMK Research offers a different picture in which just two acquisitions formed a significant proportion of the total deals done in the period (almost 30% of all the investments), and another significant proportion was raised through bonds. The acquisition component is perhaps an outlier and is unlikely to repeat in other years, but the bond component could continue to play a significant role in the country’s renewable and solar investments, especially as the country scales towards much larger installations.

Other FI investments

Institutional investments are also being made into the Indian solar power sector by both Indian and foreign investors – mutual funds, pension funds, insurance companies etc.

For instance, SBI Energy Opportunity Fund invests in publicly traded solar companies and projects, diversifying its portfolio with renewable energy assets.

There has been significant investments from the FDI route as well. It was announced in Parliament in 2023 that the country’s renewable energy sector had attracted about $6.1 billion during the past three years from FDI, a large portion of which, I’m sure would have flown into solar power plants.

Development finance

Development Finance Institutes (DFIs) are specialized institutions that provide financial support for projects that contribute to the economic development of a region, often focusing on sustainable and infrastructure projects. DFIs offer long-term financing solutions tailored to the unique needs of solar projects. They provide not only financial support but also technical expertise to ensure project success.

The World Bank had provided significant financial support in building out solar parks and other renewable energy infrastructure in the country.

In 2024, the International Finance Corporation (IFC), the private sector lending arm of the World Bank, pledged USD 105 million to part-finance a 550 Megawatt peak (MWp) solar power project in Rajasthan.

In June 2024, ADB approved a total funding assistance of $240 million for rooftop solar power sector in India, to be disbursed through SBI & NABARD. Other disbursements from ADB from here,

In 2023, Small Industries Development Bank of India (SIDBI) announced 100% funding for green and clean projects of MSMEs, marking a significant step towards green financing. Organizations such as SIDBI also partner with solar sector stakeholders in facilitating such finance. For instance, in 2023 it partnered with Tata Power to launch affordable financing for solar rooftops, creating an easy and affordable financing scheme for MSME customers.

Power Finance Corporation (PFC) finances large-scale solar projects (here is an example), contributing to the expansion of India’s renewable energy capacity., and has disbursed significant amounts for the construction of GW-scale solar projects in states such as Rajasthan and Telangana.

Other prominent development finance organizations that have played a role in the growth of the Indian solar power sector are Rural Electrification Corporation (REC), Germany’s Kreditanstalt fuer Wiederaufbau (KfW), US EXIM Bank, Japanese Bank for International Cooperation (JBIC), Japan International Cooperation Agency (JICA), European Investment Bank etc. Of these, IREDA deserves a special note. Organizations such as REC also obtain their funds from a number of sources including green bonds. Interestingly, organizations such as REC are expanding their scope of financing activities beyond their original objective; for instance, in 2023, Serentica Renewables obtained Rs 3000 crores from REC for deploying solar-wind hybrid renewable energy projects in Karnataka, and a larger Rs 4500 crore loan to SJVN Renewables in 2024.

IREDA

IREDA Indian Renewable Energy Development Agency (IREDA) is a Non-Banking Financial Institution under THE administrative control of Ministry of New and Renewable Energy (MNRE) for giving term loan for renewal energy and thermal energy efficiency projects.

Similar to a traditional bank, IREDA provides finance for solar power plants – its loan can go up to 75% of the cost of the solar project venture. IREDA’s loan interest rates are lower than what can be obtained from many other sources. IREDA sources funds from a variety of agencies, including international agencies and banks.

IREDA funds projects on its own, and in many cases it does so in partnership with other financial institutions – here is an example where it partnered with Punjab National Bank.

Equity financing

All types of equity finance – from small angel investments to large private equity – are beginning to make contributions to the Indian solar power sector

Private Equity

Until a few years back, the Indian solar power was of interest to small ticket investors in equity (angel and early stage VCs) or large debt investors (prominent banks and development finance institutions).

But with the maturing of the industry, the Indian solar power sector has started offering scaled opportunities for private equity firms. These are still early days for PE activity in the Indian solar but expect it heat up starting 2025.

Some signs are already there.

In June 2023, CleanMax Enviro, a leading firm providing renewable energy solutions to corporates with a focus on rooftop solar & solar power generation for corporate clients, raised $360 million in equity funding from Brookfield Renewable.

Venture Capital

Since 2020, VC funding in India’s solar startups has accelerated. In the last few years, India has seen the emergence of a strong set of VC funds with a large climate tech focus, with some funds such as Avaana being fully dedicated to climate tech sector investments. Select investments from these VC funds have started benefitting the solar power sector.

For instance, Solar Square, a prominent rooftop solar solutions provider, has raised significant equity funding from Lightspeed, Lightrock, Elevation Capital, Lowercarbon, Rainmatter, and Gruhas Proptech.

Within VC investments, impact investing also plays a role in some solar power projects. These involve investments made with the intention to generate positive, measurable social and environmental impacts alongside financial returns. For instance, Freyr Energy, another prominent rooftop solar solutions provider, has attracted funding from impact funds such as EDFI ElectriFI (a EU-funded impact investment facility) and C4D Partners, a Dutch impact investment fund.

VCs love to invest in startups and efforts that have significant innovation and disruption built in, and hence could provide huge upsides in future valuation. However, most startups in the Indian solar sector operate in domains that are more basic engineering (solar panel making, EPCs/installers etc.,) than innovation. It doesn’t take a genius to figure out that digital/IT/AI is one of the levers that could provide the disruption and innovation edge. There are startups that are leveraging these and applying them to the solar power sector, but I have not seen anything like a Palmetto for the Indian market yet.

Asset Management Funds

As the solar sector matures in India and globally, asset management firms are starting to show interest in this sector. For instance, in 2024, BlackRock invested in Waaree Energies as an anchor investor during its IPO. In 2022, Ontario Teacher’s, a prominent Canadian pension fund, took a substantial stake in Mahindra Susten. Another prominent asset management firm that has been investing in Indian renewable & solar energy sectors is responsAbility Investments AG.

Public Markets

As any industry matures and scales, accessing public markets becomes more feasible. This is happening in the Indian solar power sector too. While there might be only a few IPO success stories right now, one can expect more in future. Of course, one of the most prominent IPO stories of recent times was that of Waaree Energies in Oct 2024.

M&A

The Indian solar power sector has also been witnessing heightened M&A activities in the past few years. The acquisitions of vary from acquisitions of small projects by assorted stakeholders (most of these deals go under the radar), acquisitions of assets of firms that are becoming insolvent (examples include those of Indo Solar by Waaree & Sun Edison’s assets by Greenko), and finally the prominent, large acquisitions of solar assets by corporates or financial entities.

Angel Investments

Post COVID, India has seen Indian angel investors take special interest in the country’s solar power sector. These also include investments by HNIs and family offices.

Other financing

Other prominent financial investment categories that have contributed to the solar power sector include institutional investments, CSR funds and Green/Renewable Energy funds

In the initial ten years of India’s solar power sector (2010-2020), significant financial supportfor the Indian solar power sector came from the central and state governments. Government financial support for the sector continues in select sectors such as residential solar and offgrid solar power systems for rural and remote communities. Government financial incentives and support take the form of viability gap funding for large projects (no longer applicable), tax incentives for the corporate sector investing in solar power plants, capital subsidies for rooftop and offgrid systems (the most prominent incentive for this sector) and in very select cases grants or 100% investment by government bodies.

Corporate CSR funds are increasingly directed towards renewable energy to align with corporate sustainability objectives. Some prominent companies whose CSR programs has strong solar components include Infosys (solar energy projects in rural areas), Wipro (solar installations in educational institutions and healthcare facilities), and Tata Group’s sustainability efforts.

It should be kept in mind that, except for select startups and innovations, most of the business efforts in the solar power sector can bring in stable, predictable revenues and margins, but there are unlikely to be high upsides, given that the ultimate product, power is a commodity. Thus, it will be difficult to find finance vehicles such as hedge funds being keen on this sector!

References

https://www.mercomindia.com/indias-top-five-solar-energy-funding-infographics

Skip to content

Skip to content