Themes in this post: Residential solar | Commercial & industrial rooftop solar | Agricultural consumers

Anyone who uses power (and that’s pretty much everyone, isn’t it?) can use solar power, in theory.

But, given that the structure of solar power generation and distribution is evolving, not everyone currently uses solar power.

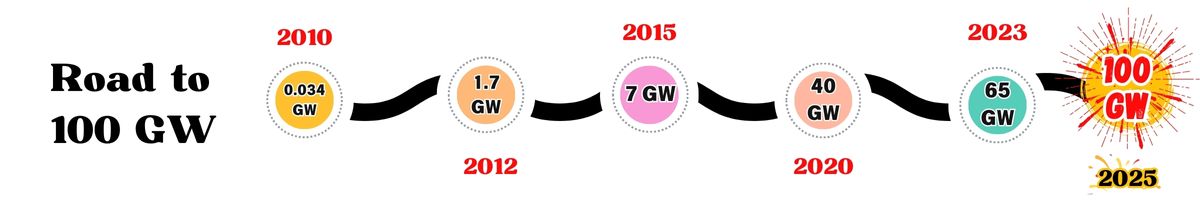

In the last ten years (since 2015) however, the number of entities in India using solar power has increased dramaticlally.

Similar to the case for conventional power use, the end users of solar power fall broadly into the following segments:

- Residential

- Commercial

- Industrial

- Agricultural

- Public & government

Residential consumers

This is a segment we all understand because it represents you and me.

The residential segment consumes solar power mostly through the installation of rooftop solar power plants. But, if we are talking about poor rural households, they could also be consuming solar power through small solar panels that could be placed right outside their homes, or even attached to equipment such as solar powered lanterns.

There can also be other ways by which solar power can be generated for communities through solar panels on streetlight poles, and also some fancy structures like solar umbrellas that can double up as a shade under which you can sit while generating power.

Overall however, most of the residential and related non-business segments generate solar power from the installation of solar panels on rooftops.

Rooftop solar power plants for the residential solar was quite slow to take off in India. In 2015, the government had set for the entire rooftop sector cumulative target of #H40 GW by 2022#H. By end of 2018, the total was just 2.6 GW, just 6% of the total target. And of this, residential solar would have been a fairly small portion as most of this would have been through medium sized commercial and industrial rooftop solar installations.

By 2024, the rooftop solar installations had grown to about 15 GW, a respectable number, but still woefully short of the 40 GW by 2022. Of this, our estimates suggest that residential rooftop would have comprised not more than 25% of the total rooftop solar, so that would be about 4 GW (20% of 15 GW) by end of 2024.

4 GW isn’t at all bad, but it can be a lot more, given the country’s potential. The #HPM’s Surya Ghar Yojana#H seems to be supercharging the residential rooftop solar installation dynamics, with recent reports suggesting that it could touch 1 million rooftop solar installations soon (8.5 lakhs was the actual number end of Jan 2025), which is about 10% of the ultimate target of 10 million (1 crore) installations by March 2027.

Commercial & industrial consumers

India’s corporate and business end users consume solar power in three ways:

- One, by putting up rooftop solar at many of their facilities – be they offices or factories

- Two, by purchasing solar power from independent power producers

- Three, by putting up their own captive power plants

Before getting into specifics, it will be instructive to understand why the commercial and industrial sectors form a critical stakeholder segment for the use of solar power for decarbonization.

Power generation contributes to about 60% of India’s total GHG emissions. Well, who uses this power? It could be residences where you and I use it, commercial establishments such as hotels, hospitals, colleges, offices; factories large and small; and also other segments such as agriculture etc.

If you consider India’s total electricity demand, #H42% is used by industries#H, about 25% by residential, close to 20% by agriculture and about 10% by the commercial sector.

If over 40% of the electricity is consumed by industries and commercial establishments, then they are indirectly responsible for a large portion of the emissions that come from thermal power plants.

Isn’t then almost only justice that these businesses try to migrate to the use of low carbon or zero carbon power?

Before the arrival of solar – pre-2010 – the only green power avenue available for these companies where they can show some green efforts was wind power. But wind power has multiple challenges to scale to the extent that Indian industry needs it to decarbonize fast.

With the arrival of solar power, which is both modular and scalable, the industries suddenly realised that they can accelerate their own net zero journeys through large scale use of solar power – by both having their own rooftops generate solar power and where they need more than what their rooftop can generate, get it from solar power plants that are put up elsewhere, through the grid.

Through large-scale use of solar power, prominent corporates such as Infosys have been able to reach significant renewable energy shares for their power consumption, with quite a few of them also having Net Zero ambitions in the not so distant future.

Commercial & industrial rooftop solar

Many prominent Indian firms have sizable amounts of rooftop solar power plants put up at their factories and warehouses

Hindustan Unilever Limited has incorporated rooftop solar photovoltaics at several of its manufacturing units and distribution centers. Marico Limited has initiated rooftop solar projects across select factories. Bosch has installed rooftop solar systems at its manufacturing facilities. Hindustan Coca-Cola Beverages has installed rooftop solar PV systems at some of its bottling plants and warehouses. Hero MotoCorp one of India’s largest two-wheeler manufacturers, has installed rooftop solar panels at select manufacturing plants to reduce grid dependency and align with sustainability targets.

In 2015, #HCochin international airport#H became India’s first airport to be powered fully by solar power, through its 12 MW solar power plant. When you drive out into the city from the airport, you can see some portions of the solar power plant’s panels as you drive along. This was one of the earliest attempts of a prominent commercial end user of power going solar all the way. Today, India’s large businesses and corporates form a key stakeholder in the solar power sector as the ones who finally pay for it!

Many of these industrial rooftop projects have capacities above 1 MW at each location. Depending on the type of operations at the factory or plant, rooftop solar power plants can contribute up to 20% of power requirements for the facility, though for industries with very large power consumption, this could be as low as 5%.

Captive solar power plants

Captive solar power plants provide the Indian corporates with their own solar power producing asset, something that can continue generating power for 25 long years, but this requires the company to invest in developing the power plant. Given the falling cost of solar power plants, and the need only for minimum O&M requirements, many Indian corporates are opting for captive solar power plants.

To make it easier for corporates to invest in captive solar power plants, many state governments leverage “group captive” frameworks. In this, a group of corporate end users needs to own only a minimum of 26% of equity of a solar power plant and should consume a minimum of 51% of the total electricity generated. The way the commercials are structured for group captive solar, it is estimated to provide significant cost savings to the corporate over the alternatives.

India’s total capacity from captive solar power plants was over 4 GW in 2023. Some of the prominent industries using captive solar included textiles, cement, chemicals and heavy engineering industries.

Prominent companies that have invested significantly in captive solar power projects include UltraTech Cement (Aditya Birla Group), ITC Limited, Hindustan Zinc (Vedanta Group), and JSW Steel.

Corporate solar power purchase

A slew of Indian corporations are purchasing solar power in large amounts from independent solar power producers such as ReNew and Azure Power. So, these are from sources outside of their rooftop solar panels or any captive solar power plants they might have installed.

Companies such as Infosys, Wipro, Amazon, Mahindra & Mahindra, Dalmia Cement and Bharat Forge are some prominent ones who are purchasing significant amounts of solar power from third party producers through medium or long term power purchase agreements (PPA).

Many of these companies have signed PPAs for fairly large amounts of solar power. Amazon alone has signed agreements for 420 MW for its operations across India. Companies such Dalmia Cement have signed PPAs to meet their sustainability goals, with commitments to source up to about 50% of its total energy needs from renewable sources by 2030.

Interestingly, First Solar, a prominent firm manufacturing thin film solar modules signed a PPA for solar & wind power to the extent of 150 MW with the renewable energy developer Cleantech Solar. Another highlight of this partnership is the proposed use of the solar modules made by First Solar in the solar power plant that will generate the power supplied to the module manufacturing facility!

Agricultural consumers

For the farming sector, a predominant use of energy is in water pumping for irrigation. India has an estimated 30 million water pumps for irrigation – that is more than the national population of about 180 countries worldwide!

It this makes sense to direct the use of solar power for water pumping. It is difficult to arrive at reliable estimates, but based on our research at Solar Mango, we feel that there could be 600,000-800,000 solar water pumps installed across India.

These are typically offgrid (not connected to grid) solar power systems with or without batteries. In fact, most Indian solar water pumps operate without batteries; they are designed to run directly from the solar panels using a DC motor, thus needing neither batteries nor inverters – this arrangement is often referred to as a “direct drive” system.

In some cases, where the solar panels provided for water pumping produces more electricity than the farmer wishes to use, the farmers can export the surplus electricity to the grid and get paid for it. This however requires enabling policies from the respective state government. An example of such a scheme is the Suryashakti Kisan Yojana scheme by the Gujarat government.

With the emergence of #Hagrivoltaics#H, in which farmers can have solar panels on the farms and grow select crops under them (in the shade), we could see some farmers in India also producing electricity along with crops – but agrivoltaics currently contributes a miniscule percentage to India’s solar power sector.

Public & government consumers

The government itself can be a large consumer of solar power.

This can happen through consumption of solar power in government firms and industries, in government infrastructure like railway stations & airports, and on many government department buildings & institutions.

There are already enough examples of solar power use in each of the above stakeholder categories. Many Indian airports and railway stations already sport solar panels on their premises or purchase solar power. A number of large government-owned firms already are significant consumers of solar power, and in many cities across the country, you can find enough government buildings dotted with solar panels.

The operational and business models used by this segment are similar to that what the industrial & commercial end user segments use, with some minor tweaks – after all, we are dealing with the government!

Skip to content

Skip to content